Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106, and Job 107- were

Question:

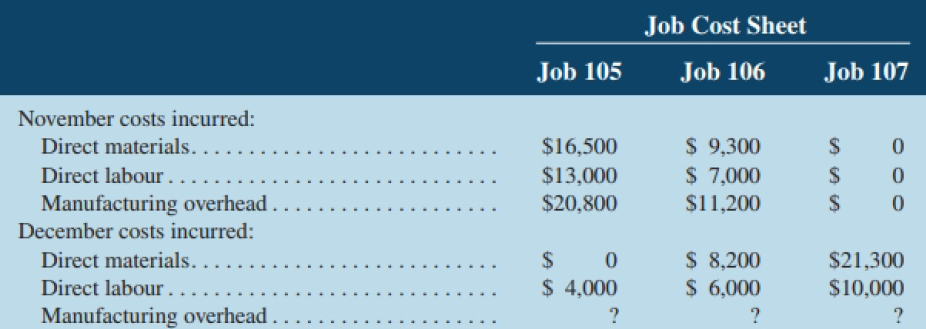

Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106, and Job 107- were worked on during November and December. Job 105 was completed on December 10; the other two jobs were still in production on December 31, the end of the company's operating year. Data from the job cost sheets of the three jobs follow:

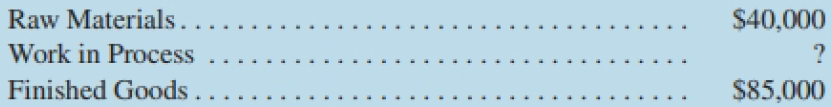

The following additional information is available: Manufacturing overhead is applied to jobs on the basis of direct labour cost. Balances in the inventory accounts at November 30 were as follows:

Required:

1. Prepare T-accounts for Raw Materials, Work in Process, Finished Goods, and Manufacturing Overhead. Enter the November 30 inventory balances given above; in the case of Work in Process, compute the November 30 balance and enter it into the Work in Process T-account.

2. Prepare journal entries for December as follows:

a. Prepare an entry to record the issue of materials into production, and post the entry to appropriate T-accounts. (In the case of direct materials, it is not necessary to make a separate entry for each job.) Indirect materials used during December totalled $4,000.

b. Prepare an entry to record the incurrence of labour cost, and post the entry to appropriate T-accounts. (In the case of direct labour cost, it is not necessary to make a separate entry for each job.) Indirect labour cost totalled $8,000 for December.

c. Prepare an entry to record the incurrence of $19,000 in various actual manufacturing overhead costs for December (credit Accounts Payable). Post this entry to the appropriate T-accounts.

3. What apparent predetermined overhead rate does the company use to assign overhead cost to jobs? Using this rate, prepare a journal entry to record the application of overhead cost to jobs for December (it is not necessary to make a separate entry for each job). Post this entry to the appropriate T-accounts.

4. As stated earlier, Job 105 was completed during December. Prepare a journal entry to show the transfer of this job off the production line and into the finished goods warehouse. Post the entry to the appropriate T-accounts.

5. Determine the balance at December 3 I in the Work in Process inventory account. How much of this balance consists of costs charged to Job 106? Job 107?

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby