Kraliks Krazy Kostumes, LLC, manufactures its own costumes for business professionals and has two main products: the

Question:

Kralik’s Krazy Kostumes, LLC, manufactures its own costumes for business professionals and has two main products: the “Accounting Nerd” and the “Master Marketer.” The Accounting Nerd is a high-volume product, selling 25,000 costumes annually, while the Master Marketer is a low-volume product, selling 5,000 costumes annually. The direct materials cost per unit is $40 for the Accounting Nerd and $30 for the Master Marketer. The direct labor costs are $12 per hour, and it takes 1 hour to make a costume. Total manufacturing overhead costs for the year are expected to be $900,000. Under a traditional approach, the company uses direct labor hours to compute its predetermined overhead rate.

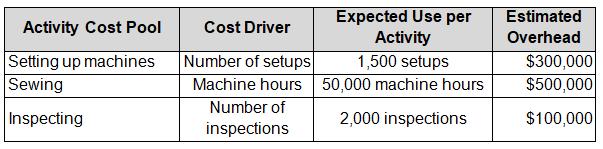

Julie Kralik, the company’s owner, decides she would like to analyze the activities being performed in the manufacturing process to better understand her costs and possibly to obtain better information with which to make decisions. In her analysis, she determines that three main activities are being performed, identifies the appropriate cost drivers, and estimates the expected use. The data she gathered are as follows:

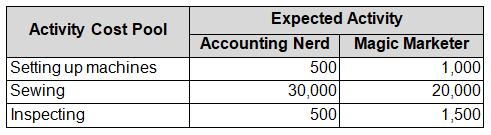

She then developed the expected use for each of her two product lines, as shown here:

a. Compute the total cost and unit cost for each of the two products under a traditional costing approach.

b. Compute the activity-based overhead rates for each activity.

c. Compute the total cost and the unit cost for each of the two products under an ABC approach. What have you learned from this analysis?

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope