Linda Trueblood, president of ProSkate, was staring at the most recent quarterly performance report and was not

Question:

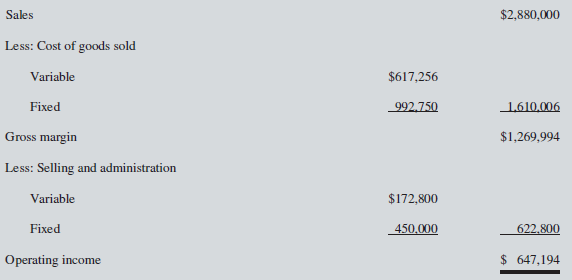

Linda Trueblood, president of ProSkate, was staring at the most recent quarterly performance report and was not pleased. “How can this be possible?” she asked of her senior management team. “I thought the market for our products had improved and that all we needed to do was maintain our budgeted market share. But this report tells me that our profits are below expectations, and I do not understand that.” She then turned her attention to the manufacturing manager, wondering what story was going to emerge from his side. The performance report she was reviewing contained the following information:

Other information is as follows:

a. Overall profit variance was $107,294 U.

b. Sales revenues were $144,000 lower than the budgeted amount.

c. Contribution margin was $105,144 lower than the budgeted amount.

d. Actual market share was about 0.535% lower than the budgeted 10%.

ProSkate manufactures two types of skates: professional and amateur. The following additional information is available:

e. The company sold 7,200 pairs of professional skates and 18,000 pairs of amateur skates during the quarter, compared with the budgeted quantities of 8,000 and 17,600, respectively.

f. Budgeted unit contribution margins for the professional and amateur models were $185.55 and $40.38, respectively.

g. Direct materials were purchased at the budgeted price of $28 per kilogram; all materials purchased were used during the period. Direct labour was paid $0.50 per hour higher than the budgeted amount of $14 per hour.

h. Total direct materials variance amounted to $5,040 (unfavourable).

i. Direct materials and direct labour used for the amateur model were the same as the budgeted quantity (0.28 kilograms per unit and 0.40 hours per unit, respectively).

j. The total direct materials and direct labour used for the professional model during the quarter were 3,060 kilograms and 5,040 hours, respectively.

k. Direct labour-hours used for the professional model were less than the budgeted quantity by 0.05 hours per unit.

l. The predetermined allocation rate for variable overhead was 130% of direct labour cost; the total (i.e., flexible budget) variable overhead variance amounted to $16,344 (favourable).

m. Fixed manufacturing overhead was underallocated by $35,527; the actual amount incurred during the quarter was $992,750. The predetermined overhead rate for fixed manufacturing overhead was based on 13,040 labour-hours.

Required:

Copy and complete the following variance table. Be sure to label each of the variances as favourable (F) or unfavourable (U).

Direct Materials VariancesPrice varianceUsage (quantity) varianceTotal direct materials variance

Direct Labour VariancesRate varianceEfficiency varianceTotal direct labour variance

Variable Manufacturing Overhead VariancesSpending varianceEfficiency varianceTotal variable manufacturing overhead variance

Fixed Manufacturing Overhead VariancesSpending varianceProduction volume varianceTotal fixed manufacturing overhead variance

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan