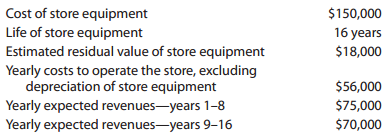

On August 1, Matrix Stores Inc. is considering leasing a building and purchasing the necessary equipment to

Question:

1. Prepare a differential analysis as of August 1, 2012, presenting the proposed operation of the store for the 16 years (Alternative 1) as compared with investing in U.S. Treasury bonds (Alternative 2).

2. Based on the results disclosed by the differential analysis, should the proposal be accepted?

3. If the proposal is accepted, what would be the total estimated income from operations of the store for the 16 years?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: