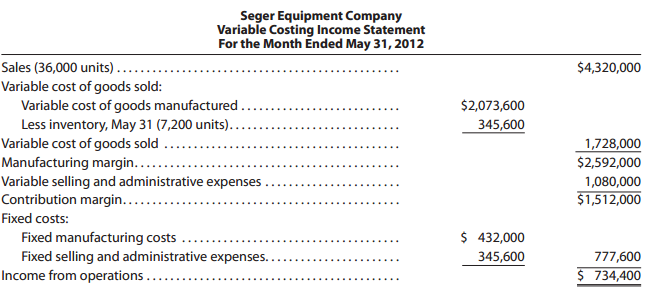

On May 31, the end of the first month of operations, Seger Equipment Company prepared the following

Question:

Prepare an income statement under absorption costing.

Transcribed Image Text:

Seger Equipment Company Variable Costing Income Statement For the Month Ended May 31, 2012 Sales (36,000 units).... $4,320,000 Variable cost of goods sold: Variable cost of goods manufactured.. $2,073,600 Less inventory, May 31 (7,200 units).. Variable cost of goods sold Manufacturing margin..... Variable selling and administrative expenses Contribution margin....... 345,600 1,728,000 $2,592,000 1,080,000 $1,512,000 Fixed costs: $ 432,000 Fixed manufacturing costs Fixed selling and administrative expenses. Income from operations.... ...... 345,600 777,600 $ 734,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

1 2073600 432000 total variable plus fixed manufacturing co...View the full answer

Answered By

Fahmin Arakkal

Tutoring and Contributing expert question and answers to teachers and students.

Primarily oversees the Heat and Mass Transfer contents presented on websites and blogs.

Responsible for Creating, Editing, Updating all contents related Chemical Engineering in

latex language

4.40+

8+ Reviews

22+ Question Solved

Related Book For

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac

Question Posted:

Students also viewed these Business questions

-

The following data were taken from the general ledger of Thornton Merchandisers on January 31, the end of the first month of operations in the current fiscal year: Merchandise inventory, January 1 ....

-

The following data were taken from the general ledger of Donald Merchandisers on January 31, the end of the first month of operations in the current fiscal year: Merchandise inventory, January 1 . ....

-

The following data were taken from the general ledger of Owens Booksellers on January 31, the end of the first month of operations in the current fiscal year: Merchandise inventory, January...

-

Taxpayer sold the following capital assets during the year: Asset # 1: $60,000 long-term capital gain Asset # 2: $10,000 long-term capital loss Asset # 3: $50,000 short-term capital gain Asset # 4:...

-

Following are the financial statements for Griffin Inc. for the year 2017: Additional information: Griffin Inc. has authorized 500,000 shares of 10%, $10 par value, cumulative preferred stock. There...

-

Integrate the following function analytically and using the trapezoidal rule, with n = 1, 2, 3, and 4: Use the analytical solution to compute true percent relative errors to evaluate the accuracy of...

-

Calculate the mean, median, and mode stock price.

-

Three venture investments previously made by BKAngel, a venture investor, achieved the following outcomes for the year just completed: A. Calculate the percentage rate of return for each of the...

-

8. When we are trying to form the optimal risky portfolio from hundreds or thousands of risky securities, the efficient frontier typically if we disallow short selling. (a) moves to the northwest (b)...

-

In his autobiography A Sort of Life, British author Graham Greene described a period of severe mental depression during which he played Russian Roulette. This "game" consists of putting a bullet in...

-

Variable manufacturing costs are $11 per unit, and fixed manufacturing costs are $55,000. Sales are estimated to be 10,000 units. a. How much would absorption costing income from operations differ...

-

Costello Industries Inc. manufactures only one product. For the year ended December 31, 2012, the contribution margin increased by $19,800 from the planned level of $888,800. The president of...

-

In Problem 1, what is the absolute value of the velocity of the moving weight as it passes through the equilibrium position?

-

Melannie Inc. sold $8,200 worth of merchandise on June 1, 2015 on credit. After inspecting the inventory, the customer determined that 10% of the items were defective and returned them to Melannie...

-

2. (20 marks) A firm wishes to produce a single product at one or more locations so that the total monthly cost is minimized subject to demand being satisfied. At each location there is a fixed...

-

Evaluate your own negotiation way. Do you have one? how you consider having an excellent negotiaiton skill could help any business person to achieve its goals.

-

j. Interest was accrued on the note receivable received on October 17 ($100,000, 90-day, 9% note). Assume 360 days per year. Date Description Dec. 31 Interest Receivable Interest Revenue Debit Credit

-

A Chief Risk Officer (CRO) is interested in understanding how employees can benefit from AI assistants in a way that reduces risk. How do you respond

-

Standard deduction A. Payments of at least $600 to independent contractors B. Annual nondeductible contributions of up to $6,000 C. Annual summary and transmittal of U.S. information returns D....

-

Cleaning Service Company's Trial Balance on December 31, 2020 is as follows: Account name Debit Credit Cash 700 Supplies Pre-paid insurance Pre-paid office rent Equipment Accumulated depreciation -...

-

A rack rate is best understood as the price of a hotels a. Rooms when no discount is offered. b. Rooms when discounts are offered. c. Most expensive room types. d. Least expensive room types.

-

In the short run, when room supply is held constant a. A decrease in demand for rooms typically leads to a decreased selling price. b. A decrease in demand for rooms typically leads to an increase in...

-

Bill OLeary could see both sides of the issue. As the general manager of the 500unit Plazamar Hotel, he knew how important it was to remember that both members of his room revenue management team now...

-

Simpson Ltd is a small IT company, which has 2 million shares outstanding and a share price of $20 per share. The management of Simpson plans to increase debt and suggests it will generate $3 million...

-

The following are the information of Chun Equipment Company for Year 2 . ( Hint: Some of the items will not appear on either statement, and ending retained earnings must be calculated. ) Salaries...

-

Alta Ski Company's inventory records contained the following information regarding its latest ski model. The company uses a periodic inventory system. Beginning inventory, January 1, 2018 1,250 units...

Study smarter with the SolutionInn App