Oxford Company has limited funds available for investment and must ration the funds among five competing projects.

Question:

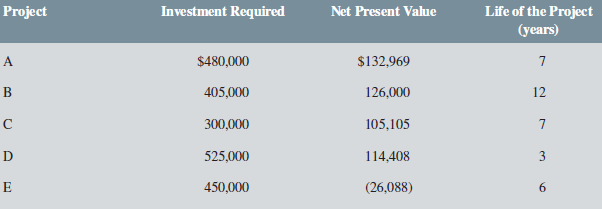

Oxford Company has limited funds available for investment and must ration the funds among five competing projects. Selected information on the five projects follows:

The net present values above have been computed using a 10% discount rate. The company wants your assistance in determining which project to accept first, which to accept second, and so on.

Required:

1. Compute the profitability index for each project.

2. In order of preference, rank the five projects in terms of

a. Net present value.

b. Profitability index.

3. Which ranking do you prefer? Why?

Life of the Project (years) Investment Required Net Present Value Project $480,000 $132,969 405,000 126,000 12 300,000 105,105 525,000 114,408 3 (26,088) 450,000 6.

Step by Step Answer:

1 The formula for the profitability index is The profitability index for each project would be Proje...View the full answer

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Business questions

-

The following three ratios have been computed using the financial statements for the year ended December 31, 2013, for Fun Science Company: Current ratio = (Current assets/Current liabilities) =...

-

The following three ratios have been computed using the financial statements for the year ended December 31, 2011, for Fun Science Company: The following additional information has been assembled:...

-

Hewie Limited has some capital available for investment and is considering two projects, only one of which can be financed. The details are as follows: Required: Advise management on which project...

-

A curve C in three dimensions is given parametrically by (x(t), y(t), z(t)), where t is a real parameter, with a t b. Show that the equation of the tangent line at a point P on this curve where t...

-

The number of deaths caused by automobile accidents, D, per hundred thousand population in the United States is given for various years, t. D. C. Heath, 1949, p. 246.) a. Make a scatter plot of the...

-

What is eminent domain?

-

What are the inputs and the outputs of the Google business?

-

1. Refer to Appendix 2, Marketing by the Numbers, and calculate 2006 market shares by volume for Nestl, PepsiCo, and Coca-Cola in the bottled water market. 2. How much revenue did one market share...

-

On March 1, 2018, Garden Company invests $21,000 in Firs, Inc. stock. Furs pays Garden a $1,100 dividend on July 1, 2018. Garden sells the Firs's stock on July 31. 2018, for $21,200. Assume the...

-

The Golda Bear items listed below for the month of September, 2016. Owners Capital, September 1 $47,000 Accounts payable 7,000 Equipment 35,000 Service revenue 28,000 Owners Drawings 6,000 Insurance...

-

A piece of labour-saving equipment has just come onto the market, which Mitsui Electronics Ltd. could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow...

-

Digger Company is evaluating an investment of $330,000 in earth moving equipment. Management anticipates net cash savings of $100,000 in year 1. The savings will increase by 40% in year 2 and then...

-

Round the following numbers (i) to one decimal place and (ii) to two decimal places. a. 4.383 b. 5.719 c. 5.803 d. 1.477 e. 3.999 f. 6.273

-

Two firms are bidding for a $100 million contract in an all-pay auction. The bidding continues over many rounds, and each firm must incur a non-recoverable cost equal to 1% of the total value of the...

-

Illustrate the different steps required for the insertion of 58 followed by the deletion of 40 in the following AVL tree. 55 40 50 65 60 60 57 70 70

-

3 undamaged, the suit is returned to the customer. If either (or both) of the parts is (are) damaged, the suit goes to customer relations (Server 5). Assume that all travel times are negligible (0),...

-

Saginaw Incorporated completed its first year of operations with a pretax loss of $677,500. The tax return showed a net operating of $826,500, which the company will carry forward. The $149,000...

-

General Average Problem You've just learned about the concept of general average. Try applying it to the following hypothetical: A cruise ship docks close to Rome for three days, giving the...

-

In a particular city there are 51 buildings of historical interest. The following table presents the ages of these buildings, given to the nearest 50 years. a. Write down the lower and upper boundary...

-

For all of the following words, if you move the first letter to the end of the word, and then spell the result backwards, you will get the original word: banana dresser grammar potato revive uneven...

-

Marco Brolo is one of three partners who own and operate Silkroad Partners, a global import-export business. Marco is the partner in charge of recording partnership transactions in the accounts. On...

-

There are two common causes of business and accounting fraud: A failure of individual character A culture of greed or ethical indifference within an organization Write a brief memo describing how...

-

Buddy Dupree is the accounting manager for On-Time Geeks, a tech support company for individuals and small businesses. As part of his job, Buddy is responsible for preparing the company's trial...

-

X Your answer is incorrect. Flounder Consulting Corp. company records revealed the following for the current year: What was the net cash flow from operating activities for the year? $ 0 $ 9 8 0 0...

-

Assume that interest rate parity holds. The U.S. fiveyear interest rate is 0.08 annualized, and the Mexican fiveyear interest rate is 0.05 annualized. Todays spot rate of the Mexican peso is $0.21....

-

find the NSP of a whole life insurance.6 with $100,000 Death benefits, for a female aged 105 years, if i=10%? (use Australian life Tables 2005-07) find the NSP of a whole life insurance.6 with...

Study smarter with the SolutionInn App