Paulson Company has recently leased facilities for the manufacture of a new product. Based on studies made

Question:

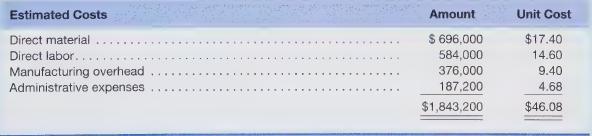

Paulson Company has recently leased facilities for the manufacture of a new product. Based on studies made by its accounting personnel, the following data are available: Estimated annual sales: 40,000 units.

Selling expenses are expected to be 10% of sales, and the selling price is $64 per unit. Ignore income tax in this problem.

Required

a. Compute a break-even point in dollars and in units. Assume that manufacturing overhead and administrative expenses are fixed but that other costs are variable.

What would net income before income tax be if 30,000 units were sold?

c. How many units must be sold to earn a net income before income tax of 10% of sales?

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.