Refer to the data for Glenn Real Estate Appraisal in Problem 4-27A. After journalizing and posting Cilenn's

Question:

Refer to the data for Glenn Real Estate Appraisal in Problem 4-27A. After journalizing and posting Cilenn's adjusting and closing entries, prepare the company's income statement for the year ended June 30, 2009. L List expenses in descending order-largest first, second-largest next, and so on.

Problem 4-27A

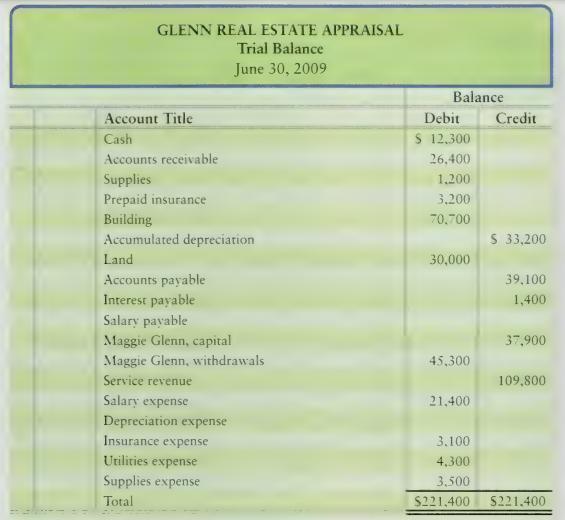

The unadjusted trial balance of Glenn Real Estate Appraisal at June 30, 2009 follows.

Adjustment data at June 30, 2009:

a. Prepaid insurance expired, \(\$ 3,000\).

b. Accrued service revenue, \(\$ 900\).

c. Accrued salary expense, \(\$ 700\).

d. Depreciation for the year, \(\$ 11,200\).

e. Supplies used during the year, \(\$ 200\).

Requirements

1. Open T-accounts for Maggie Glenn, Capital and all the accounts that follow. Insert their unadjusted balances. Also open a T-account for Income Summary, which has a zero balance.

2. Journalize the adjusting entries and post to the accounts that you opened. Show the balance of each revenue account and each expense account.

3. Journalize the closing entries and post to the accounts that you opened. Draw double underlines under each account balance that you close to zero.

4. Compute the ending balance of Maggie Glenn, Capital.

Step by Step Answer: