Refer to the information presented in PA9-4 regarding Black & Deckers handisaw. Required: Prepare the following for

Question:

Refer to the information presented in PA9-4 regarding Black & Decker’s handisaw.

Required:

Prepare the following for the first quarter:

1. Cost of goods sold budget.

2. Selling and administrative expense budget.

3. Budgeted income statement for the handisaw product.

Data from PA9-4

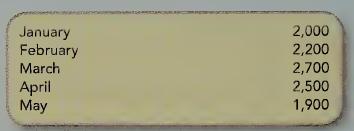

Black & Decker (B&D) manufactures a wide variety of tools and accessories. One of its more popular items is a cordless power handisaw. Use the following fictitious information about this product line to complete the problem requirements. Each handisaw sells for \($40\). B&D expects the following unit sales.

B&D’s ending finished goods inventory policy is 25 percent of the next month’s sales.

Suppose each handisaw takes approximately 0.75 hours to manufacture, and B&D pays an average labor wage of \($16.50\) per hour.

Each handisaw requires a plastic housing that B&D purchases from a supplier at a cost of \($7.00\) each. The company has an ending raw materials inventory policy of 20 percent of the following month’s production requirements. Materials other than the housing unit total \($4.50\) per handisaw.

Manufacturing overhead for this product includes \($72,000\) annual fixed overhead (based on production of 27,000 units) and \($1.10\) per unit variable manufacturing overhead. B&D’s selling expenses are 7 percent of sales dollars, and administrative expenses are fixed at \($18,000\) per month.

Step by Step Answer:

Managerial Accounting

ISBN: 9780078110771

1st Edition

Authors: Stacey WhitecottonRobert LibbyRobert Libby, Patricia LibbyRobert Libby, Fred Phillips