Refer to the information provided in M4?13. Barry Gold, a tax client of Sunrise Accounting, requires 20

Question:

Refer to the information provided in M4?13. Barry Gold, a tax client of Sunrise Accounting, requires 20 miles of transportation, 50 hours of processing time, and 3 hours of office support. Using the activity rates calculated in M4?13, determine the amount of overhead assigned to Barry Gold.

M4-13

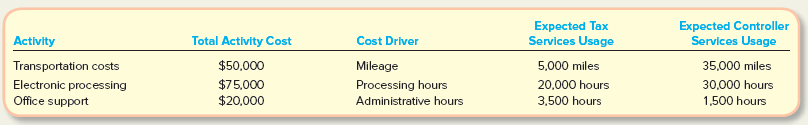

Sunrise Accounting provides basic tax services and ?rent-a-controller? accounting services. Sunrise has identified three activity pools, the related costs per pool, the cost driver for each pool, and the expected use for each pool. Compute the activity rate for each of the activity pools.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 978-1260413984

4th edition

Authors: Stacey Whitecotton, Robert Libby, Fred Phillips

Question Posted: