Rosman Company has an opportunity to pursue a capital budgeting project with a five-year time horizon. After

Question:

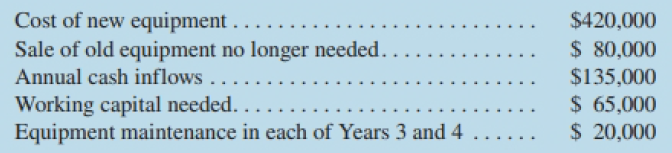

Rosman Company has an opportunity to pursue a capital budgeting project with a five-year time horizon. After careful study, Rosman estimated the following costs and revenues for the project:

The new piece of equipment mentioned above has a useful life of five years and zero salvage value. The old piece of equipment mentioned above would be sold at the beginning of the project and there would be no gain or Joss realized on its sale. Rosman uses the straight-line depreciation method for financial reporting and the CCA rate for tax purposes is 20%. The company's tax rate is 30% and its after-tax cost of capital is 12%. When the project concludes in five years the working capital will be released for investment elsewhere within the company.

Required:

Compute the net present value of this investment opportunity. Round all dollar amounts to the nearest whole dollar. Would you recommend that the contract be accepted?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Capital Budgeting

Capital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby