Selected transactions of Taylor Company, completed during the fiscal year ended December 31, are as follows: Instructions

Question:

Selected transactions of Taylor Company, completed during the fiscal year ended December 31, are as follows:

Instructions

Journalize the preceding transactions.

Transcribed Image Text:

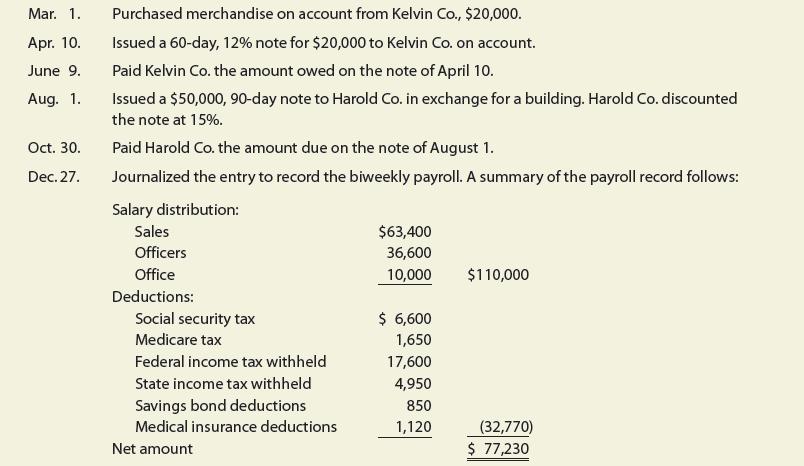

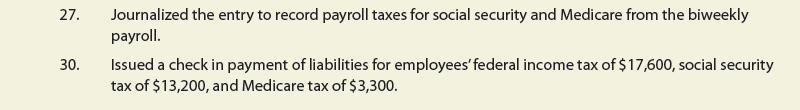

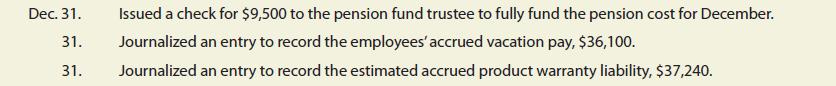

Mar. 1. Apr. 10. June 9. Aug. 1. Oct. 30. Dec. 27. Purchased merchandise on account from Kelvin Co., $20,000. Issued a 60-day, 12% note for $20,000 to Kelvin Co. on account. Paid Kelvin Co. the amount owed on the note of April 10. Issued a $50,000, 90-day note to Harold Co. in exchange for a building. Harold Co. discounted the note at 15%. Paid Harold Co. the amount due on the note of August 1. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Sales Officers Office Deductions: Social security tax Medicare tax Federal income tax withheld State income tax withheld Savings bond deductions Medical insurance deductions Net amount $63,400 36,600 10,000 $ 6,600 1,650 17,600 4,950 850 1,120 $110,000 (32,770) $ 77,230

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Mar 1 Inventory Accounts PayableKelvin Co Apr 10 Accounts PayableKelvin Co Notes Payable June 9 Note...View the full answer

Answered By

Fahmin Arakkal

Tutoring and Contributing expert question and answers to teachers and students.

Primarily oversees the Heat and Mass Transfer contents presented on websites and blogs.

Responsible for Creating, Editing, Updating all contents related Chemical Engineering in

latex language

4.40+

8+ Reviews

22+ Question Solved

Related Book For

Financial And Managerial Accounting

ISBN: 9781337902663

15th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William B. Tayler

Question Posted:

Students also viewed these Business questions

-

Keokuk Corp. had the following operating results for 2021 & 2020. Keokuk paid dividends of $100,000 per year for both years and made capital expenditures of $45,000 in both years. The company's stock...

-

MMP Limited (a privately held corporation) is a retail operation that sells pet supplies. The company owns the building from which it operates the business and rents office space as well. The share...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Consider a stylized two-period model with banking. The aggregate abatement cost function in period t is given by C(E)= (a t be) 2 /2b with a 1 < a 2 is D(E)=dE 2 /2. (a) Determine the optimal...

-

Air at 600 K flows with 3 kg/s into a heat exchanger and out at 100oC. How much (kg/s) water coming in at 100 kPa, 20oC can the air heat to the boiling point?

-

Describe the two techniques for knowledge elicitation via the use of stories.

-

What do some economists, such as Anthony Downs and William Niskanen, claim about motives and incentives in public organizations? What is public service motivation? How does Perry define and measure...

-

City Taxi purchases a new taxi cab for $25,000. The cab has an estimated salvage value of $1,000 and is expected to be driven for approximately 120,000 miles over its useful life of five years....

-

Project X has an initial cost of $68,893, and its expected net cash inflows are $13,500 per year for 8 years. The firm has a WACC of 7 percent, and Project Xs risk would be similar to that of the...

-

A business issued a $5,000, 60-day, 12% note to the bank. The amount due at maturity is: a. $4,900 b. $5,000 c. $5,100 d. $5,600

-

On October 3, Bering Industries Inc. is considering two alternatives for a short-term loan from Community Bank: (1) issue a $60,000, 60-day, 5% note or (2) issue a $60,000, 60-day note that the bank...

-

Refer to Exercise 6.55. In exercise a. To what populations are the conclusions obtained in Exercise 6.55 relevant? b. A more precise estimate of the mean expenditure for female candidates is...

-

Winston Electronics reported the following information at its annual meetings. The company had cash and marketable securities worth $1,235,740, accounts payables worth $4,160,391, inventory of...

-

Hooray Company has been manufacturing 12,000 units of Part A which is used to manufacture one of its products. At this level of production, the cost per unit is as follows: Direct materials P 4.80...

-

At the beginning of the period, the Grinding Department budgeted direct labor of $171,200 and property tax of $57,000 for 10,700 hours of production. The department actually completed 12,800 hours of...

-

The following information is available for Shamrock Corporation for the year ended December 31, 2025. Beginning cash balance $ 58,500 Accounts payable decrease 4,810 Depreciation expense 210,600...

-

In today's stock market, compounding is the key to making money in the future for one's investments. However, with decentralized currency growing rapidly (Crypto), how can one rely on TVM for FV...

-

Raul lives in Georgia. He creates custom paintings and sells them at a weekly art fair near Atlanta. Sarah lives in Vermont. While on vacation in Georgia, she buys one of Raul's paintings for $500....

-

Portal Manufacturing has total fixed costs of $520,000. A unit of product sells for $15 and variable costs per unit are $11. a). Prepare a contribution margin income statement showing predicted net...

-

On June 30, the end of the first year of operations, Johnson Industries, Inc., manufactured 4,500 units and sold 4,000 units. The following income statement was prepared, based on the variable...

-

On June 30, the end of the first month of operations, Clowney Company prepared the following income statement, based on the absorption costingconcept: Clowney Company Absorption Costing Income...

-

Life Sound Company manufactures two models of noise-canceling headphones: Noise. Resistant and Total Silence models. The company is operating at less than full capacity. Market research indicates...

-

If you purchase a $1000 par value bond for $1065 that has a 6 3/8% coupon rate and 15 years until maturity, what will be your annual return? 5.5% 5.9% 5.7% 6.1%

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

Study smarter with the SolutionInn App