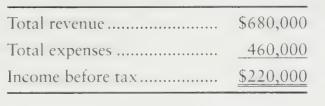

The accounting records of Dwter Minerals Corporation provide income statement data for 2008. Total expenses include depreciation

Question:

The accounting records of Dwter Minerals Corporation provide income statement data for 2008.

Total expenses include depreciation of \(\$ 50,000\) computed under the straight-line method. In calculating taxable income on the tax return, Dwyer uses MAC.RS. MAC.RS depreciation was \(\$ 70,000\) for 2008. The corporate income tax rate is \(35 \%\).

Requirements

1. Compute Dwyer's taxable income for the year. For this computation, substitute MACRS depreciation expense in place of straight-line depreciation.

2. Journalize the corporation's income tax for 2008.

3. Show how to report the two income tax liabilities on Dwyer's classiwww.MyAccountingLab.com fied balance sheet.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: