The accounts of Haley-Davis Printing Company include Land, Buildings, and Equipment. Haley-Davis has a separate accumulated depreciation

Question:

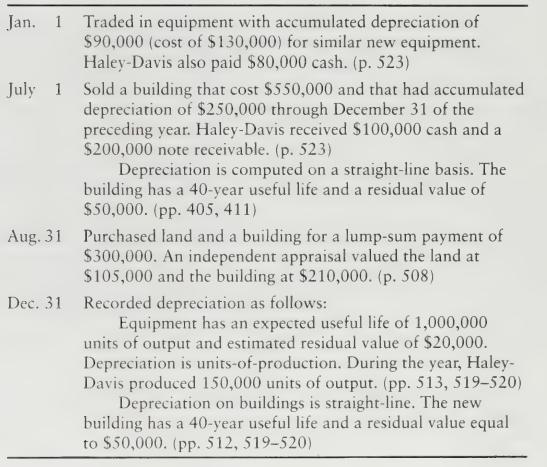

The accounts of Haley-Davis Printing Company include Land, Buildings, and Equipment. Haley-Davis has a separate accumulated depreciation account for each asset. During 2007 , the company completed the following transactions:

Requirement

Record the transactions in Haley-Davis's journal.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: