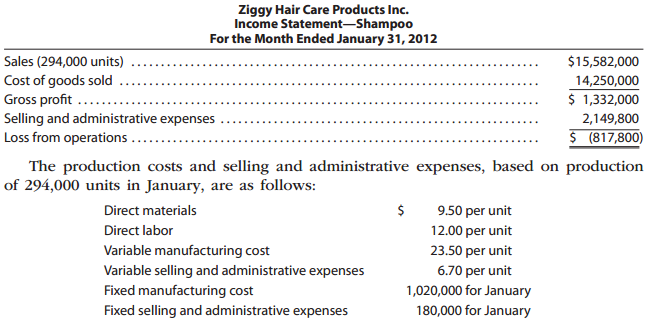

The demand for shampoo, one of numerous products manufactured by Ziggy Hair Care Products Inc., has dropped

Question:

Sales for February are expected to drop about 30% below those of the preceding month. No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with shampoo. The inventory of shampoo at the beginning and end of February is expected to be inconsequential.

1. Prepare an estimated income statement in absorption costing form for February for shampoo, assuming that production continues during the month.

2. Prepare an estimated income statement in variable costing form for February for shampoo, assuming that production continues during the month.

3. What would be the estimated loss in income from operations if the shampoo production were temporarily suspended for February?

4. What advice should the controller give to management?

Step by Step Answer:

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac