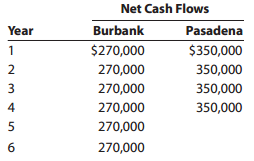

The investment committee of Fiesta Cantina Restaurants Inc. is evaluating two restaurant sites. The sites have different

Question:

The committee has selected a rate of 20% for purposes of net present value analysis. It also estimates that the residual value at the end of each restaurant€™s useful life is $0, but at the end of the fourth year, Burbank€™s residual value would be $440,000.

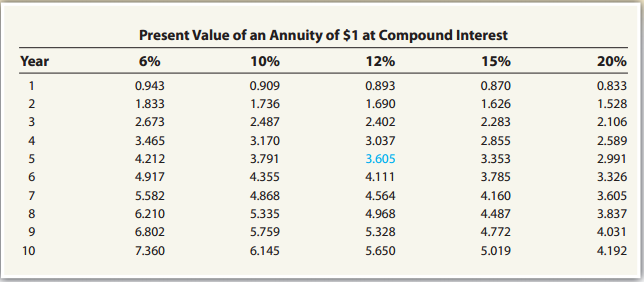

1. For each site, compute the net present value. Use the present value of an annuity of $1 table appearing in this chapter (Exhibit 2). (Ignore the unequal lives of the projects.)

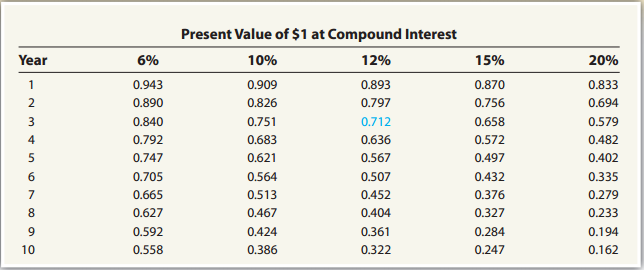

2. For each site, compute the net present value, assuming that Burbank is adjusted to a four-year life for purposes of analysis. Use the present value of $1 table appearing in this chapter (Exhibit 1).

3. Prepare a report to the investment committee, providing your advice on the relative merits of the two sites.

Exhibit 1:

Exhibit 2:

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Annuity

An annuity is a series of equal payment made at equal intervals during a period of time. In other words annuity is a contract between insurer and insurance company in which insurer make a lump-sum payment or a series of payment and, in return,...

Step by Step Answer: