The Lovejoy Hotel upgrades its conference facilities approximately every five years so that it can book larger,

Question:

The Lovejoy Hotel upgrades its conference facilities approximately every five years so that it can book larger, more profitable conventions than if it had older décor and technologies.

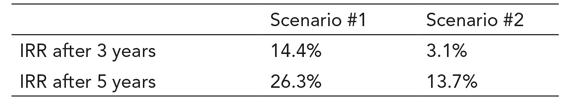

Managers at Lovejoy are evaluating a potential conference facilities upgrade plan that would require an initial investment of $1,200,000. Managers want to analyze the upgrade plan using two scenarios, a most likely scenario and a worst-case scenario. Lovejoy has a 15% hurdle rate for this type of investment.

Scenario #1 is the most likely scenario. If Lovejoy chooses this upgrade plan, it expects that total revenue will increase by $720,000 in Year 1, $475,000 in Year 2, $310,000 in Year 3, $295,000 in Year 4, and $125,000 in Year 5. After five years, Lovejoy expects that it will be able to sell the furniture and fixtures purchased during this facility upgrade for $75,000 and embark on another upgrade.

Scenario #2 is the worst case scenario. Under the worst case scenario, Lovejoy will see total revenue increase by $612,000 in Year 1, $404,000 in Year 2, $248,000 in Year 3, $206,000 in Year 4, and $110,000 in Year 5. After five years in this worst-case scenario, Lovejoy assumes a residual value of zero for the furniture and fixtures from the upgrade.

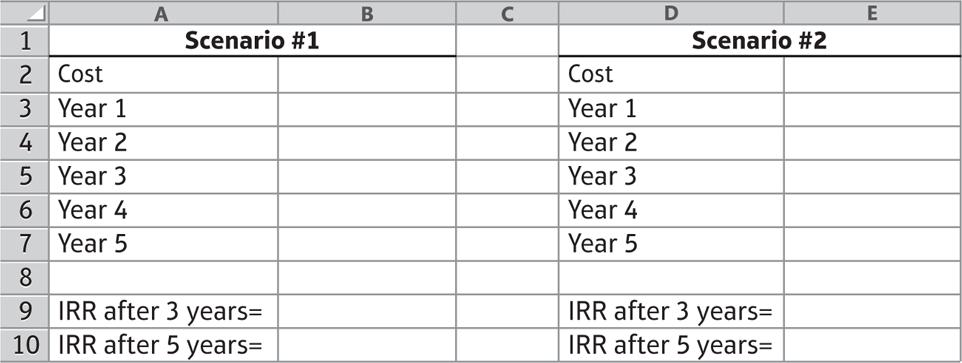

Here is the basic Excel worksheet format that Lovejoy uses to analyze investments:

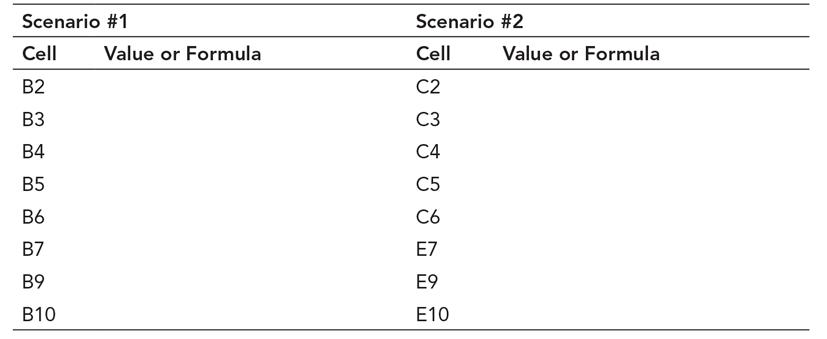

1. In the Excel worksheet pictured above, what values or formulas would be entered in the specified cells in the following table?

2. Assume that Lovejoy calculates the IRR under both scenarios. Those results are listed below. Based on this IRR analysis, should Lovejoy undertake this conference facility upgrade? Explain.

Step by Step Answer: