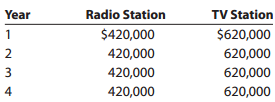

The management of Saturn Networks Inc. is considering two capital investment projects. The estimated net cash flows

Question:

The radio station requires an investment of $1,275,540, while the TV station requires an investment of $1,770,100. No residual value is expected from either project.

1. Compute the following for each project:

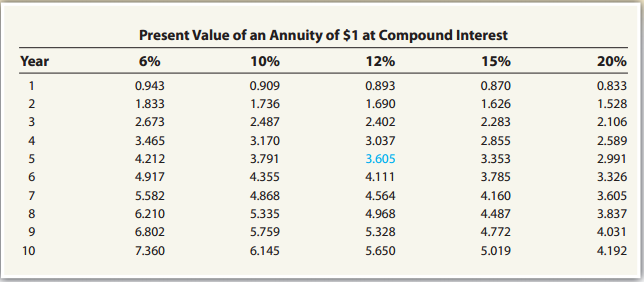

a. The net present value. Use a rate of 10% and the present value of an annuity of $1 table appearing in this chapter (Exhibit 2).

b. A present value index. Round to two decimal places.

2. Determine the internal rate of return for each project by (a) computing a present value factor for an annuity of $1 and (b) using the present value of an annuity of $1 table appearing in this chapter (Exhibit 2).

3. What advantage does the internal rate of return method have over the net present value method in comparing projects?

Exhibit 2:

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Step by Step Answer: