The valve division of Bendix Inc. produces a small valve that is used by various companies as

Question:

The valve division of Bendix Inc. produces a small valve that is used by various companies as a component part in their products. Bendix Inc. operates its divisions as autonomous units, giving its divisional managers great discretion in pricing and other decisions. Each division is expected to generate a rate of return of at least 14% on its operating assets. The valve division has average operating assets of $700,000. The valves are sold for $5 each. Variable costs are $3 per valve, and fixed costs total $462,000 per year. The division has a capacity of 300,000 valves each year.

Required:

1. How many valves must the division sell each year to generate the desired rate of return on its assets?

a. What is the margin earned at this level of sales?

b. What is the turnover at this level of sales?

2. Assume that the division?s current ROI is just equal to the minimum required 14%. In order to increase the division?s ROI, the divisional manager wants to increase the selling price per valve by 4%. Market studies indicate that an increase in the selling price would cause sales to drop by 20,000 units each year. However, operating assets could be reduced by $50,000 due to decreased needs for accounts receivable and inventory. Compute the margin, turnover, and ROI if these changes are made.

3. Refer to the original data. Assume again that the valve division?s current ROI is just equal to the minimum required 14%. Rather than increase the selling price, the sales manager wants to reduce the selling price per valve by 4%. Market studies indicate that this would fill the plant to capacity. In order to carry the greater level of sales, however, operating assets would increase by $50,000. Compute the margin, turnover, and ROI if these changes are made.

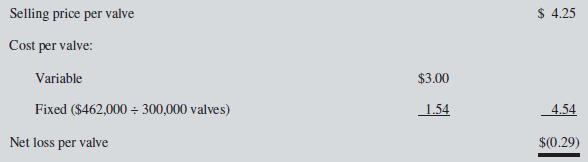

4. Refer to the original data. Assume that the normal volume of sales is 280,000 valves each year at a price of $5 per valve. Another division of the company is currently purchasing 20,000 valves each year from an overseas supplier, at a price of $4.25 per valve. The manager of the valve division has adamantly refused to meet this price, even though he has the production capacity to accommodate the production, pointing out that it would result in a loss for his division:

The manager of the valve division also points out that the normal $5 selling price barely allows his division the required 14% rate of return. ?If we take on some business at only $4.25 per unit, then our ROI is obviously going to suffer,? he reasons, ?and maintaining that ROI figure is the key to my future. Besides, taking on these extra units would require us to increase our operating assets by at least $50,000 due to the larger inventories and receivables we would be carrying.? If the manager of the valve division accepts the transfer price of $4.25 for 20,000 units, how would that decision impact the valve division?s ROI? Should the manager of the valve division accept the price of $4.25 per valve? Why, or why not?

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan