Toasted Treats Snack Company is considering two possible investments: a delivery truck or a bagging machine. The

Question:

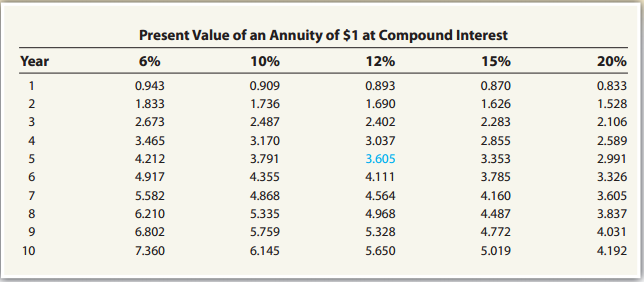

a. Compute the internal rate of return for each investment. Use the present value of an annuity of $1 table appearing in this chapter (Exhibit 2).

b. Provide a memo to management with a recommendation.

Exhibit 2:

Contribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: