Question: Use the data in Exercises 8-27 and 8-28 to analyze the accounts receivable turnover ratios of H.J. Heinz Company and The Limited Brands Inc. a.

Use the data in Exercises 8-27 and 8-28 to analyze the accounts receivable turnover ratios of H.J. Heinz Company and The Limited Brands Inc.

a. Compute the average accounts receivable turnover ratio for The Limited Brands Inc. and H.J. Heinz Company for the years shown in Exercises 8-27 and 8-28.

b. Does The Limited Brands or H.J. Heinz Company have the higher average accounts receivable turnover ratio?

c. Explain the logic underlying your answer in (b).

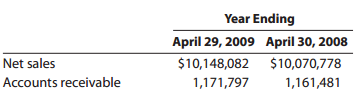

Data from Exercise 8-27:

H.J. Heinz Company was founded in 1869 at Sharps burg, Pennsylvania, by Henry J. Heinz. The company manufactures and markets food products throughout the world, including ketchup, condiments and sauces, frozen food, pet food, soups, and tuna. For the fiscal years 2009 and 2008, H.J. Heinz reported the following (in thousands):

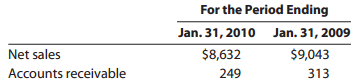

Data from Exercise 8-28:

The Limited Brands Inc. sells women€™s clothing and personal health care products through specialty retail stores including Victoria€™s Secret and Bath & Body Works stores. The Limited Brands reported the following (in millions):

Year Ending April 29, 2009 April 30, 2008 $10,148,082 $10,070,778 1,171,797 Net sales Accounts receivable 1,161,481 For the Period Ending Jan. 31, 2010 Jan. 31, 2009 $9,043 $8,632 Net sales Accounts receivable 249 313

Step by Step Solution

3.32 Rating (167 Votes )

There are 3 Steps involved in it

a The average accounts receivable turnover ratios are as follows The Limited Brands Inc 289 307 271... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1737_60b75c543ade2_723144.pdf

180 KBs PDF File

1737_60b75c543ade2_723144.docx

120 KBs Word File