(a) Modify the Millers Tax Computation program in Figure 1.2 to include a tax deduction for educator...

Question:

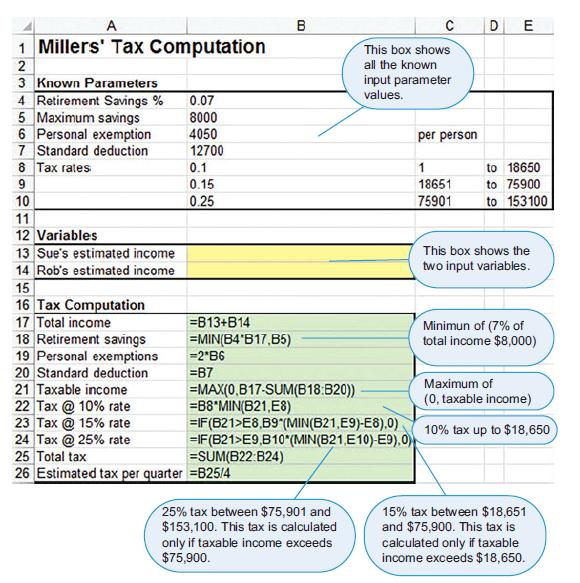

(a) Modify the Millers’ Tax Computation program in Figure 1.2 to include a tax deduction for educator expenses.

(b) Next modify the program to account for a growing family. In particular, instead of having two personal exemptions hard-coded in the Tax Computation formula for “Personal exemptions,” create a parameter for “Number of exemptions.” Refer to that parameter in the Tax Computation formula for “Personal exemptions.”

(c) Suppose Rob has educator expenses of $200, and the couple now has one child. Compute their updated estimated tax per quarter.

Figure 1.2

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Decision Modeling Business Analytics With Spreadsheet

ISBN: 9781501515101

4th Edition

Authors: Nagraj Balakrishnan, Barry Render, Ralph Stair, Charles Munson

Question Posted: