A consortium of business professors at a city university are thinking of investing in the takeout food

Question:

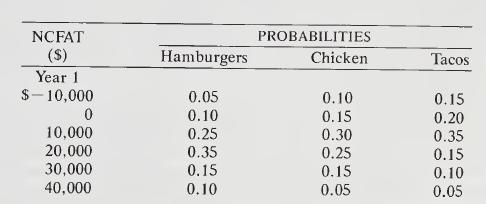

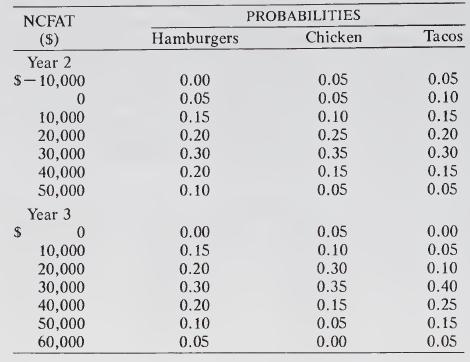

A consortium of business professors at a city university are thinking of investing in the takeout food industry. A location has been found which is considered to be highly suitable because of its proximity to thousands of downtown offices and stores, a major stadium, and two very large high schools. The professors are in the process of deciding whether they should go with ham¬ burgers, chicken, or tacos as their product line. Extensive studies have provided the following estimated probabilities for various levels of net cash flow after taxes in each of the first three years for each of the three projects.

The above net cash flows after taxes do not include the initial franchise fee of $50,000 for hamburgers; $40,000 for chicken; and $35,000 for tacos. They do allow for depreciation, how¬ ever. The professors’ time horizon is only three years, since they are all on three-year contracts at the university and expect their research and teaching efforts to suffer so badly that their con¬ tracts will not be renewed and they will have to go elsewhere for a job. Their collective judgment is that the opportunity discount rate is 15 percent for hamburgers, 13 percent for chicken, and 16 percent for tacos. Treat the expected net cash flows after taxes as arriving continuously throughout each year and the probability distributions as being independent of each other.

(a) Calculate the expected net present value of each alternative, assuming that the franchise fee cannot be recovered at the end of the period.

(b) Estimate the payback period for each project, using the undiscounted net cash flows after taxes.

(c) Advise the professors as to which project, if any, to undertake. Support your recommenda¬ tion.

Step by Step Answer: