The Omega Investment Corporation has more than half a million dollars to invest as the result of

Question:

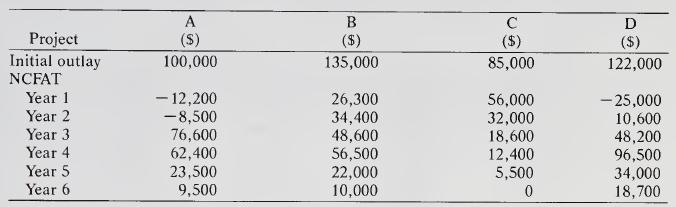

The Omega Investment Corporation has more than half a million dollars to invest as the result of a recent windfall gain from the revaluation of a foreign currency it was holding. Failing all else, these funds can be invested in government bonds, which are considered to be risk free, at 8 percent per annum. Omega is evaluating four other investment projects as well. These projects seem to be equally risky, and Omega feels they should return at least 10 percent per annum in order to be considered an equivalent proposition to placing the funds in the risk-free bonds. The initial outlays and net cash flows after taxes (NCFAT) for each year of each project’s life are as follows:

You are asked to advise Omega about which of these projects, if any, it should undertake. Explain your reasoning.

Step by Step Answer: