Suppose in Technical Problem 2 that the price probabilities are reversed: The manager expects a price of

Question:

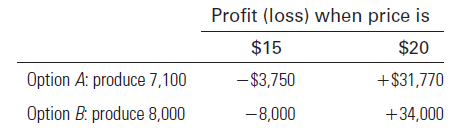

Suppose in Technical Problem 2 that the price probabilities are reversed: The manager expects a price of $15 with a probability of 60 percent and a price of $20 with a probability of 40 percent. Answer all parts of Technical Problem 2 under the assumption of these reversed probabilities. What would the probabilities have to be to make the expected values of the two options equal?

Data From Problem 2

A firm is making its production plans for next quarter, but the manager of the firm does not know what the price of the product will be next month. He believes that there is a 40 percent probability the price will be $15 and a 60 percent probability the price will be $20. The manager must decide whether to produce 7,000 units or 8,000 units of output. The following table shows the four possible profit outcomes, depending on which output management chooses and which price actually occurs:

Step by Step Answer:

Managerial Economics Foundations of Business Analysis and Strategy

ISBN: 978-0078021909

12th edition

Authors: Christopher Thomas, S. Charles Maurice