The manager in Technical Problem 5 receives an offer from another party to buy the rights to

Question:

The manager in Technical Problem 5 receives an offer from another party to buy the rights to the risky project described in that problem. This party offers the manager $3,200, which the manager believes will be paid with certainty.a. The utility of $3,200 is _____________.b. Comparing the utility of $3,200 with the expected utility of the risky project (you calculated this for part b of Technical Problem 5), what should the manager do if the manager wishes to maximize expected utility of profit? Explain.c. Is your decision in part b consistent with the manager?s attitude toward risk as it is reflected by the utility function for profit? Explain.d. Is the decision consistent with the mean?variance rules for decision making under risk? Explain.

Data From Problem 5

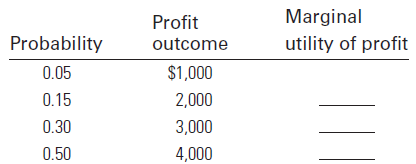

Suppose the manager of a firm has a utility function for profit of U(?) = 20 ln(?), where ? is the dollar amount of profit. The manager is considering a risky project with the following profit payoffs and probabilities:

Step by Step Answer:

Managerial Economics Foundations of Business Analysis and Strategy

ISBN: 978-0078021909

12th edition

Authors: Christopher Thomas, S. Charles Maurice