relative performance evaluation Ralph is at it again. Output from the produetion proeess owned by Ralph ean

Question:

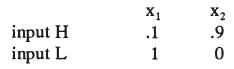

relative performance evaluation Ralph is at it again. Output from the produetion proeess owned by Ralph ean be Xl or X2• The manager's input ean be L or H. Ralph is risk neutral. The probabilities are:

Ralph wants supply of input H.

The manager is risk averse, and is described by the usual personal eost and eonstant risk aversion story. The manager's utility is U(W) = -exp(-rW). Wealth w is the net of payment I and personal eost el. Let CH = 5,000 and eL = 1,000, and r = .0001. Also, the manager's opportunity eost is U(M), with M = 4,000. The only observable for contracting purposes is the manager's output.

a] Detennine an optimal pay-for-perfonnanee arrangement.

b] Suppose Ralph owns two such produetion processes and employs an identieal manager on eaeh. Further suppose the two environments are perfeetly eorrelated.

So if both managers supply input H, their outputs will always agree (both Xl or both x2). Suppose Ralph offers to pay eaeh 9,000 if their outputs agree and zero otherwise.

Verify that if one manager supplies input H the best the other ean do is supply input H.

e] What happens in the arrangement in [b] above if one manager supplies input L?

Is the other's best response also to supply input L? How do you think the managers will play the game?

d] Amend Ralph's scheme in [b] so that, in the game played between the two managers, both supplying input H is a unique equilibrium. Give an intuitive explanation for why your modifieation leads to a unique equilibrium. What diffieulty is associated with your scheme?AppendixLO1

Step by Step Answer: