Optimistic Enterprises, Inc. (OEI) has developed and patented a product for the home entertainment industry. Some industry

Question:

Optimistic Enterprises, Inc. (OEI) has developed and patented a product for the home entertainment industry. Some industry experts predict that in two to five years the market for this technology could grow to $200 million in annual sales. Unfortunately, due to a series of mistakes by management, the product has failed to gain traction in the marketplace.

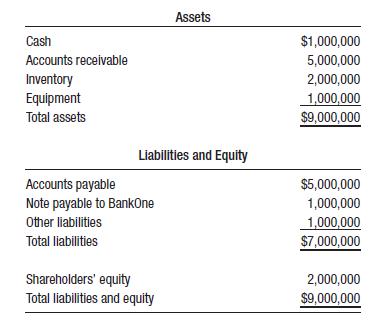

OEI is also being sued for patent infringement by its chief competitor. OEI has operated at a loss, and its current expenses exceed revenues by $250,000 on a quarterly basis. OEI has a revolving line of credit with BankOne; the credit facility is secured by a lien against all of the company’s assets. OEI’s balance sheet is as follows:

OEI has exhausted all efforts to cut its operating expenses, including two rounds of employee layoffs. The company has stretched its accounts payables to ninety days or longer, except for key suppliers, and resorted to making partial rent payments for its manufacturing facility.

Included within OEI’s “other” liabilities are accrued, but unpaid, employee withholding taxes in the amount of $250,000.

Antonio Pardelli, a significant shareholder and director of OEI, has formed Pardelli Acquisitions Corporation (PAC) to acquire OEI’s technology, inventory, and manufacturing equipment. He has presented OEI’s board with PAC’s offer to buy these assets for $3 million in cash. As part of the offer, PAC will acquire OEI’s key engineers and attempt to renegotiate the lease to continue operating at the same location. PAC has also agreed to fund separate severance packages for OEI’s senior executives upon closing of the sale. PAC will not assume any of OEI’s debts.

OEI will retain its cash and accounts receivables. PAC has waived any due diligence or other contingencies to the sale, provided that the sale closes in ten days. Is OEI in the zone of insolvency? Should the OEI board accept PAC’s offer? What actions, if any, should OEI’s board undertake before considering or accepting the offer? What actions, if any, could creditors take to challenge or threaten the sale?

Should OEI consider filing for bankruptcy?

Step by Step Answer:

Managers And The Legal Environment Strategies For The 21st Century

ISBN: 9781439040058

6th International Edition

Authors: Constance E. Bagley, Diane Savage