Bottle-Up, Inc., was organized on January 8, 2008, and made its S election on January 24, 2008.

Question:

Bottle-Up, Inc., was organized on January 8, 2008, and made its S election on January 24, 2008. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individuals materially participate in Bottle-Up's single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C:11-2 through C:11-4. Ignore the U.S. (domestic) production activities deduction. Prepare a 2017 S corporation tax return for Bottle-Up, showing yourself as the paid preparer.

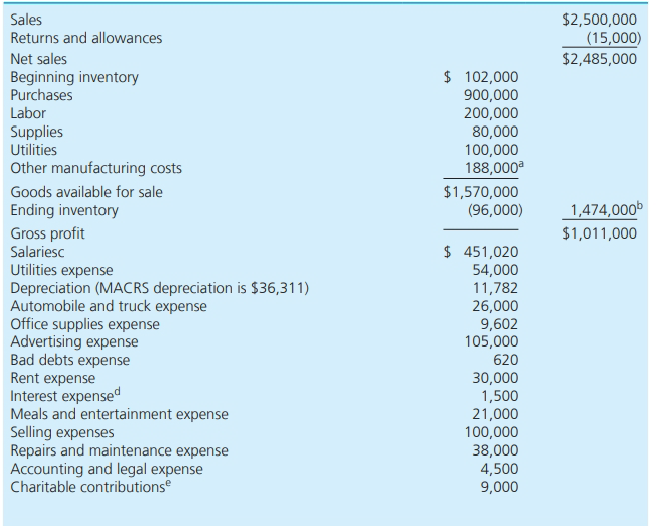

Tables C:11-2:

aTotal MACRS depreciation is $74,311. Assume that $38,000 of depreciation has been allocated to cost of sales for both book and tax purposes so that the book and tax inventory and cost of sales amounts are the same. The AMT depreciation adjustment on personal property is $9,000.

bThe cost of goods sold amount reflects the Uniform Capitalization Rules of Sec. 263A. The appropriate restatements have been made in prior years.

cOfficer salaries of $ t 20,000 are included in the total. All are employer's W-2 wages.

dInvestment interest expense is $500. All other interest expense is trade- or business-related. None of the interest expense relates to the production of tax-exempt income.

eThe corporation made all contributions in cash to qualifying charities.

fIncludes $3,000 of premiums paid for policies on lives of corporate officers. Bottle-Up is the beneficiary for both policies.

gThe corporation acquired the capital assets on March 3, 2015 for $100,000 and sold them on September 15, 2017. for $148,666.

hThe corporation acquired the Sec. 1231 property on June 5, 2016 for $10,000 and sold it on December 21, 2017, for $8,900.

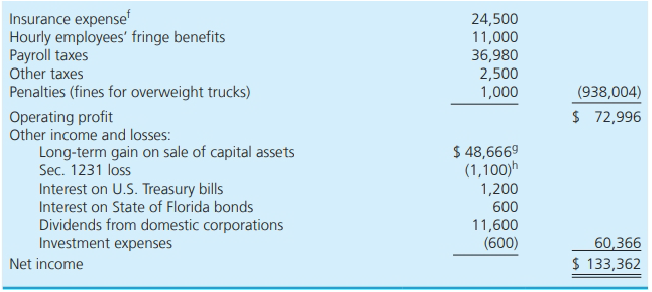

Tables C:11-4:

Step by Step Answer:

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf