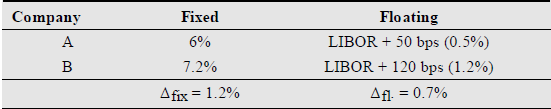

Consider the financing conditions in Table 18.2 on page 436 for companies A and B. Assume that

Question:

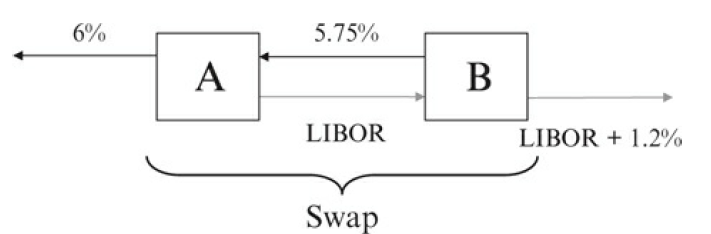

Consider the financing conditions in Table 18.2 on page 436 for companies A and B. Assume that a financial intermediary C offers both companies a payer and a receiver swap to realize comparative advantages. C takes 20 bps of the comparative difference to insure herself against default of one counterparty. The rest is divided equally between A and B. Sketch the new situation as in Figure 18.13 and compare the funding costs for A and B.

Table 18.2 Financing conditions for A and B

Fig 18.13

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: