Imagine a financial market with one zero-coupon bond and one stock. The risk-free rate of interest over

Question:

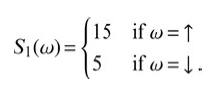

Imagine a financial market with one zero-coupon bond and one stock. The risk-free rate of interest over one period of time is r = 25% and the initial value of the stock is S0 = $10. There are two possible states of the world at t = 1, say ?up? and ?down,? and the stock takes values

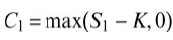

Now a call option on the stock is introduced into the market. Its payoff function is

with exercise price K = $13. Compute the risk neutral probabilities and the fair price C0 of the derivative contract.

(15 if w=1 S1(w) = 15 if w = Į. |C = max(Sj – K,0)

Step by Step Answer:

The risk neutral probabilities can be calculated as pup r dd...View the full answer

Related Video

A call option is a type of financial contract that gives the holder the right, but not the obligation, to buy an underlying asset (such as a stock, commodity, or currency) at a specified price (called the strike price) within a specified period of time. When an investor purchases a call option, they are essentially betting that the price of the underlying asset will rise above the strike price before the option\'s expiration date. If the price of the asset does rise above the strike price, the investor can exercise the option by buying the asset at the strike price and then selling it at the higher market price, thereby earning a profit. Call options are often used as a speculative investment strategy, as they allow investors to potentially profit from the upward movement of an asset without having to actually own the asset itself. They are also commonly used as a hedging tool to protect against potential losses in a portfolio.

Students also viewed these Business questions

-

A one-year long forward contract on a non-dividend-paying stock is entered into when the stock price is $40 and the risk-free rate of interest is 10% per annum with continuous compounding. a) What...

-

A company has assets with a market value of $100. It has one outstanding bond issue, a zero coupon bond maturing in two years with a face value of $75. The risk-free rate is 5 percent. The volatility...

-

The market value of Fords' equity, preferred stock and debt are $7 billion, $3 billion, and $10 billion, respectively. Ford has a beta of 1.8, the market risk premium is 7%, and the risk-free rate of...

-

How can adults continue to function relatively normally after surgery to remove the thymus, tonsils, spleen, or lymph nodes?

-

Write an equation for the reaction of bromine at room temperature with a. Propene b. 4-methylcyclohexene

-

The value of a company's equity is $4 million and the volatility of its equity is 60%. The debt that will have to be repaid in 2 years is $15 million. The risk-free interest rate is 6% per annum. Use...

-

How do you address conflicts?

-

Margrethe and Charles Pyeatte, a married couple, agreed that she would work so that he could go to law school and that when he finished, she would go back to school for her masters degree. After...

-

Requirement 1. Prepare a Statement of Cash Flows for Banana World using the Comparative Balance Sheet and additional information. The year ended on December 31, 2025 and the indirect method will be...

-

A rancher has a six-year old pony that weighs about 180 pounds. A pony of this age and size needs about 6.2 Mcal of digestible energy, 260 grams of protein, and 9,700 IU of vitamin A in her daily...

-

Consider the payoff matrix Check if the financial market is complete, and whether or not any cyclical permutation of the security price form results in an arbitrage free market. (1 2 D= 3 (s] = (1 2...

-

Convince yourself that the set K in Figure 5.2 left is not convex. Figure 5.2. K M

-

One of your customers is delinquent on his accounts payable balance. Youve mutually agreed to a repayment schedule of $500 per month. You will charge 0.9 percent per month interest on the overdue...

-

Give an algorithm for converting a tree to its mirror. Mirror of a tree is another tree with left and right children of all non-leaf nodes interchanged. The trees below are mirrors to each other....

-

5. Consider the classes below and determine what is printed out by the client code. public class V { public void one(){ System.out.print("it"); } public void two(){ System.out.print("go"); } } public...

-

Consider the following closed economy short-run IS-LM model with income taxation. The economy is described by equations (1) through (6): (1) C = 200 + 0.8(Y -T); (2) T = 800+0.25Y;(3) G = 500; (4) 1...

-

(30 pts) A binary search tree is given, write a method to delete a node from the tree. Assume the successor and predecessor methods are provided, partial code is provided below. Finish the reset of...

-

Reminder: Formatting is always important in your code (comments, indentation, variable names, etc.) And please always start your Java code file with a multi-line comment listing the name of the...

-

On June 30, 2013, Auburn Limited issued 12% bonds with a par value of $800,000 due in 20 years. They were issued at 98 and were callable at 104 at any date after June 30, 2020. Because of lower...

-

"Standard-cost procedures are particularly applicable to process-costing situations." Do you agree? Why?

-

Sam and Taylor, residents of New Jersey, entered in to a domestic partnership in New Jersey in October 2004. However, they never obtained a marriage license. Sam died in March 2018, survived by...

-

George Tanner died October 2, 2017, survived by his son Thomas and his daughter Gigi Tanner Stewart and her children, Sam and Cindy. George was the sole stockholder of Tanner, Inc., a C corporation....

-

Your firm has prepared the estate tax return (Form 706) for the Estate of Belinda Baker, a widow who died January 13, 2018. Besides substantial amounts of cash, mostly in certificates of deposit, she...

-

OMEGA Hotel provides a type of rooms with a sale price of 50 euros. Its total fixed cost amounts to 100,000 euros. The variable cost per room was estimated at 25 euros. The dead point in rooms is:...

-

You are required to use a financial calculator or spreadsheet (Excel) to solve 10 problems (provided on page 5) on the applications of the time value of money. You are required to show the following...

-

Mongo Bongo sells $7,500 of its bongos on credit on a daily basis. Because Mongo Bongo deals with beatniks, it takes 75 days to collect its A/R. (1a) What is the average A/R that is reported on...

Study smarter with the SolutionInn App