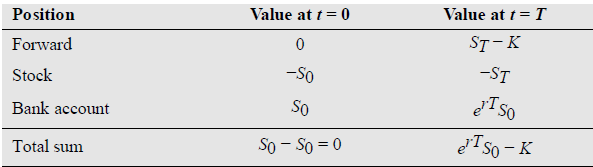

Use an arbitrage argument, analogous to the one in Table 11.1 on page 212, to prove that

Question:

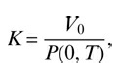

Use an arbitrage argument, analogous to the one in Table 11.1 on page 212, to prove that in a stochastic interest rate world, the strike price of a forward contract Ft(K, T) that can be entered costlessly at time t = 0 has to be

which is the forward price of a non-dividend paying underlying V at t = 0.

Table 11.1 Forward arbitrage portfolio

In finance, the strike price of an option is the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: