An extended version of the Vasicek model takes the form (Hull and White, 1990) Let (t) denote

Question:

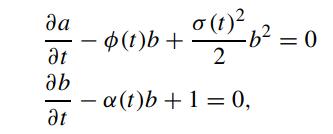

An extended version of the Vasicek model takes the form (Hull and White, 1990)

![drt = [0 (t) + a(t)(drt)] dt + o(t) dZt.](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/7/7/957655cc2a54b1521700577954384.jpg)

Let λ(t) denote the time dependent market price of risk. Show that the bond price equation is given by

![where at ar + [(t) a(t)r]j + g(t)2 a2 B 2 ar2 - r B = 0, (t) = a(t)d +0(t) - 2(t)o (t).](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/7/7/977655cc2b96ba6f1700577974342.jpg)

Suppose we write the bond price B(r, t; T) in the form

![]()

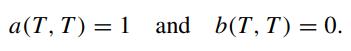

Show that a(t, T) and b(t, T) are governed by

with auxiliary conditions:

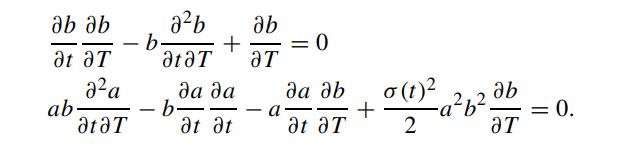

Solve for a(t, T) and b(t, T) in terms of α(t), ∅(t) and σ(t). It is desirable to express a(t, T) and b(t, T) in terms of a(0, t) and b(0, t) instead of α(t) and ∅(t). Show that the new set of governing equations for a(t, T) and b(t, T), independent of α(t) and ∅(t), are given by

The auxiliary conditions are the known values of a(0, T) and b(0, T), a(T, T) = 1 and b(T, T) = 0. Finally, show that the solutions for b(t, T) and a(t, T), expressed in terms of b(0, T) and a(0, T), are given by

![b(t, T) = a(t, T) = b(0, T) b(0, t) ab 37 (0, T) T a(0, T) a(0, t) a b(t, T)[a(0, T)]|T=t - b(t, T) ab T](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/7/8/122655cc34aaf6a81700578119753.jpg)

Step by Step Answer: