Assume that the T-maturity discounted bond price process B(t,T) follows the one-factor Gaussian HJM under the risk

Question:

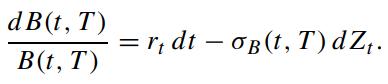

Assume that the T-maturity discounted bond price process B(t,T) follows the one-factor Gaussian HJM under the risk neutral measure Q:

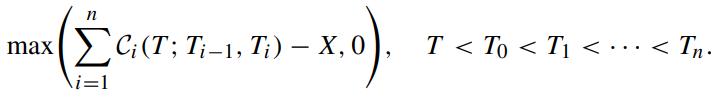

A caption is a call option on a cap, whose terminal payoff at time T is given by

A caption is a call option on a cap, whose terminal payoff at time T is given by

Here, Ci(T ; Ti−1,Ti) is the time-T value of a caplet with payment on the LIBOR Li−1 at time Ti and X is the strike price, i = 1, 2, ··· ,n. Since a cap can be visualized as a series of put options on the zero-coupon bonds, a caption is seen as a compound call on a put. By applying Jamshidian’s decomposition technique (Jamshidian, 1989) for an option on a coupon-bearing bond, find the time-t value of the caption, t < T.

Transcribed Image Text:

dB (t, T) B(t, T) =r, dt - oB(t, T) dZ₁.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

To find the timet value of the caption using Jamshidians decomposition technique lets consider the s...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

We would like to price the floor on the composition defined in Problem 8.22 using the LIBOR Market model. Now, we assume that the LIBOR Li(t) follows the arithmetic Brownian process: Problem 8.22...

-

The holder of a European in-the-money call option may suffer loss in profits if the asset price drops substantially just before expiration. The limited period fixed strike lookback feature may help...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Listed below are the genders of the younger winner in the categories of Best Actor and Best Actress for recent and consecutive years. Do the genders of the younger winners appear to occur randomly? F...

-

Wilson Company sells 130 units daily. Each time Wilson orders more units, the supplier takes four days to deliver the inventory. What is Wilsons reorder point (in number of units)?

-

Using the data from Exercise 7 "Car Weight and Fuel Consumption," the linear correlation coefficient is r = -0.987. Data From Exercise 7. Use Table 2-11 on page 71 to find the critical values of r....

-

Describe the discipline of organizational change management. AppendixLO1

-

On January 2, 2008, McGregor Co. issued at par $45,000 of 9% bonds convertible in total into 4,000 shares of McGregors common stock . No bonds were converted during 2008. Throughout 2008, McGregor...

-

The controller of Ivanhoe Industries has collected the following monthly expense data for use in analyzing the cost behavior of maintenance costs. Total Maintenance Costs Total Machine Hours Month...

-

Consider a European call option with strike price X maturing at T on a futures whose underlying asset is a T-maturity discount bond. Derive the value of this option under the Gaussian HJM term...

-

Consider a swap with reset dates T 0 ,T 1 , ,T n1 and payment dates T 1 ,T 2 , ,T n . A trigger swap is a contract where the holder has to enter into a swap with fixed swap rate K over the...

-

This year, Hassell Company will ship 4,000,000 pounds of chocolates to customers with total order filling costs of $900,000. There are two types of customers: those who order 50,000 pound lots (small...

-

Let $N$ be a positive integer. Consider the relation $\circledast$ among pairs of integers $r, s \in \mathbb{Z}$ defined as $r \circledast s$ when $r-s$ is an integer multiple of $N$. Prove that...

-

Draw a circuit diagram for a typical home hair dryer. To which form (or forms) of energy is electric potential energy converted when you use the dryer?

-

Draw a vector field diagram for particles carrying charges \(+2 q\) and \(-q\) separated by a distance \(r\). Comment on the significance of the vector diagram.

-

(a) Show that the Jones matrix of a polarization analyzer set at angle \(\alpha\) to the \(X\)-axis is given by \[ \underline{\mathbf{L}}(\alpha)=\left[\begin{array}{cc} \cos ^{2} \alpha & \sin...

-

Let \(\mathbf{V}(t)\) be a linearly filtered complex-valued, wide-sense stationary random process with sample functions given by \[ \mathbf{v}(t)=\int_{-\infty}^{\infty} \mathbf{h}(t-\tau)...

-

Provide a recursive definition for each of the following languages A* where E = {0, 1}. (a) x A if (and only if) the number of 0's in x is even. (b) x A if (and only if) all of the l's in x precede...

-

A company has the following incomplete production budget data for the first quarter: In the previous December, ending inventory was 200 units, which was the minimum required, at 10% of projected...

-

Define conflict.

-

Explain contemporary perspectives of conflict.

-

Contrast task, relationship, and process conflict.

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App