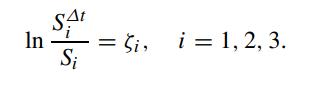

Consider a three-state option model where the logarithmic return processes of the underlying assets are given by

Question:

Consider a three-state option model where the logarithmic return processes of the underlying assets are given by

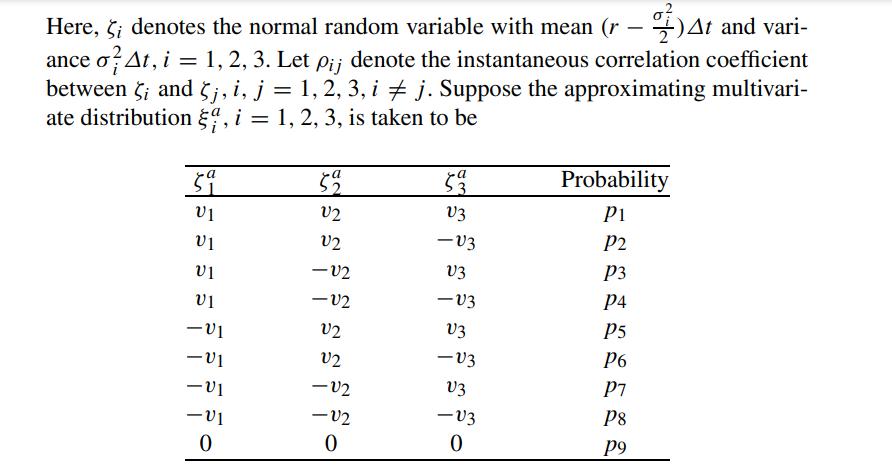

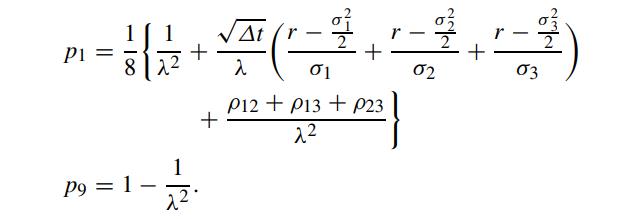

where vi = λσi √Δt, i = 1, 2, 3. Following the Kamrad–Ritchken approach, find the probability values so that the approximating discrete distribution converges to the continuous multivariate distribution as Δt → 0. Hint: The first and last probability values are given by

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: