Consider futures on an underlying asset that pays N discrete dividends between t and T and let

Question:

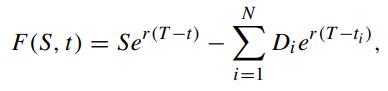

Consider futures on an underlying asset that pays N discrete dividends between t and T and let Di denote the amount of the ith dividend paid on the ex-dividend date ti. Show that the futures price is given by

where S is the current asset price and r is the riskless interest rate. Consider a European call option on the above futures. Show that the governing differential equation for the price of the call, cF (F, t), is given by (Brenner, Courtadon and Subrahmanyan, 1985)

![acF at + N [F + De] BFF - TF = 0. Die' (T- 2 rcf OF2 i=1](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/7/6/737655b3741319171700476730924.jpg)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: