Consider the forward payer swap settled in advance, that is, each reset date is also a settlement

Question:

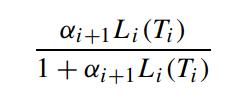

Consider the forward payer swap settled in advance, that is, each reset date is also a settlement date. The LIBOR Li(t) reset at Ti is used to determine the cash flow at Ti. Suppose the payments made at Ti are discounted by the factor 1/1+αi+1Li(Ti) so that the floating cash flow is defined to be.

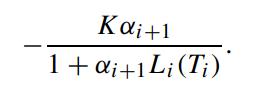

while the fixed cash flow is

Here, αi+1 is the accrual factor over (Ti,Ti+1]. Show that the time-t value of this forward payer swap is equal to that of the vanilla swap with the same fixed swap rate K.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: