Consider the value of a European call option written by an issuer whose only asset is

Question:

Consider the value of a European call option written by an issuer whose only asset is α (

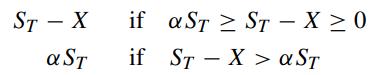

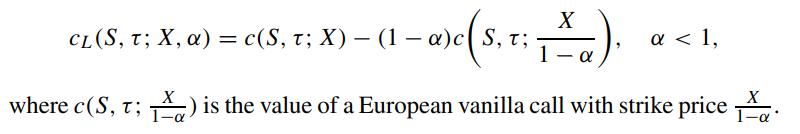

and zero otherwise. Show that the value of this European call option is given by (Johnson and Stulz, 1987)

and zero otherwise. Show that the value of this European call option is given by (Johnson and Stulz, 1987)

Transcribed Image Text:

ST - X a ST aST STX ≥ 0 if if STX a ST

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

The structure youre describing for the European call option involves ...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider a stock of XYZ Firm . It has an expected return of 10% per year, and it has a estimated return volatility of 20% per year. The risk-free rate is 6% per year (CCR). XYZ stock has a current...

-

You have been asked to estimate the beta of a high-technology firm which has three divisions with the following characteristics. Division Personal Computers Software Computer Mainframes Beta Market...

-

There are three assets, A, B and C, where A is the market portfolio and C is the risk-free asset. The return on the market has a mean of 12% and a standard deviation of 20%. The risk-free asset...

-

Suppose that you are holding your toy submarine under the water. You release it and it begins to ascend. The graph models the depth of the submarine as a function of time. What is the domain and...

-

Presented below are account balances for Monterey Hospital. In addition, cash transactions for the year ended December 31, 2012, are summarized in the T-account. Required: Using the information above...

-

The University of Toronto Press is wholly owned by the university. It performs the bulk of its work for other university departments, which pay as though the Press were an outside business...

-

How is book value per share computed for a corporation with no preferred stock? What is the main limitation of using book value per share to value a corporation? AppendixLO1

-

The figure shows a sector of a circle with central angle θ. Let A (θ) be the area of the segment between the chord PR and the arc PR. Let B (θ) is the area of the triangle PQR. Find...

-

The bond payable was sold on 1/1/20 for $5,452,336. The bond maturity value is $4,800,000 and the coupon rate is 10% payable semi-annually on July 1 and December 31. The original maturity term was 10...

-

Deduce the corresponding put-call parity relation when the parameters in the European option models are time dependent, namely, volatility of the asset price is (t), dividend yield is q(t) and...

-

Consider a European capped call option whose terminal payoff function is given by where X is the strike price and M is the cap. Show that the value of the European capped call is given by where c(S,...

-

Find the second derivative of the function. f(x) = x cos x

-

Go to: https://www.instagram.com/ryderseyewear/ on your desktop, laptop, or mobile (or a combination of all 3). You are the new Social Media Marketing Manager for Ryders Eyewear. You've been asked...

-

As leaders, it is very important that we have the ability to assess our own motivation and the motivation of others around us. It is also important to recognize the key factors involved in...

-

At the end of this exam, you will find Article 1 - " How Companies Can Prepare for a Long Run of High Inflation ". Please read the article and, when necessary, consult additional sources and the...

-

You can develop your capabilities as a manger by better understanding different ways of motivating and rewarding employees. You can also better prepare for your own career by better understanding the...

-

Topic: Project Malasakit of Kara David https://projectmalasakit.org/ What is the pros and cons of these alternative courses of the action below: Strengthen the internal organization via promoting it...

-

By interpreting each of the following integrals as an area and then calculating this area by a y-integration, evaluate: (a) (b) dx

-

Prove the result that the R 2 associated with a restricted least squares estimator is never larger than that associated with the unrestricted least squares estimator. Conclude that imposing...

-

Distinguish between the following pairs of items that appear on operating statements: (a) Gross sales and net sales, (b) Purchases at billed cost and purchases at net cost.

-

How does gross margin differ from gross profit? From net profit?

-

Explain the similarity between markups and gross margin. What connection do markdowns have with the operating statement?

-

If John invested $20,000 in a stock paying annual qualifying dividends equal to 4% of his investment, what would the value of his investment be 5 years from now? Assume Johns marginal ordinary tax...

-

help asap please!

-

Please, help asap! I have one day. Feedback will be given. & show some work. [in Excel] For the final project you will need you to create a spreadsheet /proforma of the cash flows from a property....

Study smarter with the SolutionInn App