Let B (t, T) denote the volatility structure of the return of a discount bond. The

Question:

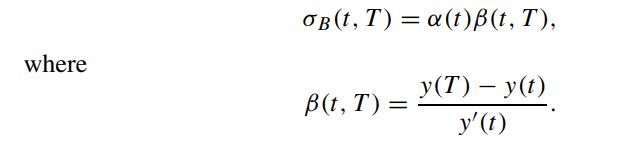

Let σB(t, T) denote the volatility structure of the return of a discount bond. The Gaussian term structure models are characterized by (i) deterministic σB(t, T) and (ii) a Markov short rate process. Show that a necessary and sufficient condition for a one-factor HJM model to be Gaussian is given by (Hull and White, 1993a)

Transcribed Image Text:

where OB (t, T) = a(t)ß(t, T), B(t, T) = y(T) - y(t) y' (t)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

The onefactor HeathJarrowMorton HJM model is characterized by the stochastic volatility structure of ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Why might cloud computing be greener than conventional computing alternatives? Research online and share examples suggesting that cloud firms could be less environmentally taxing than if a firm built...

-

Discuss requirements for doing business in India.

-

aAs shown in Fig. 12.72, a three-phase four-wire line with a phase voltage of 120 V rms and positive phase sequence supplies a balanced motor load at 260 kVA at 0.85 pf lagging. The motor load is...

-

What amount should Coral City report for 2016 net property tax revenues? a $700,000 b $690,000 c $600,000 d $500,000

-

Dynamite Enterprises, Inc. (Dynamite), a corporation doing business in Florida, maintained a checking account at Eagle National Bank of Miami (Bank). Dynamite drew a check on this account, payable to...

-

On October 1, 20X1, Dax Corp. purchases for $125,000 a machine that Dax estimates has a useful life of 4 years and a scrap value of $5,000. Complete the depreciation schedule Year Year beginning book...

-

Let L(t,T ) denote the time-t LIBOR process L t (T, T + ] over the period (T, T + ], and i L (t, T ) be its ith component of volatility function [see (7.4.26)]. From the relation and the properties...

-

Under the one-factor InuiKijima model [see (7.4.23)], we would like to solve for B(t, T) in terms of r(t), (t), F(0,t) and other parameter functions. Define show that T = $ e - 5 K(s) ds, B(t, T) =...

-

Indicate which alcohol will undergo dehydration more rapidly when heated with H2SO4. a. b. c. d. e. f. CH OH CH2CH2OH or OH OH or CH3 or CHCH3 CHCH or CHCH3 or CH3 CH CH HCH3 or CH3CCH CH3

-

Write a Program to Remove the Vowels from a String

-

Apply Eqs. 7.7 and 7.10 directly to Eqs. 7.5 and 7.6 and derive the relations of Eqs. 7.13 and 7.14. Eq. 7.5 d = Pdv - sdT Eq. 7.6 dg = vdP - sdT Eq. 7.10 dz = (z / x)y dx + (z / y)x dy Eq. 7.13...

-

As you rewrite these sentences, replace the cliches and buzzwords with plain language (if you don't recognize any of these terms, you can find definitions online): a. Being a jack-of-all-trades, Dave...

-

Distinguish between an attractive opportunity and a breakthrough opportunity. Give an example.

-

Explain how new opportunities may be seen by defining a firms markets more pr e cisely. Illustrate for a situation where you feel there is an opportunity namely, an unsatisfied ma r ket segmenteven...

-

In your own words, explain why the book suggests that you should think of marketing strategy planning as a narrowing-down process.

-

( US$ millions ) 1 2 / 3 1 / 2 0 1 4 1 2 / 3 1 / 2 0 1 3 1 2 / 3 1 / 2 0 1 2 1 2 / 3 1 / 2 0 1 1 Net income $ 1 4 , 4 3 1 $ 1 2 , 8 5 5 $ 1 0 , 7 7 3 $ 9 , 7 7 2 Depreciation 3 , 5 4 4 2 , 7 0 9 1 ,...

-

net present value of zero

-

Suppose at Time 0 a dealer buys $100 par of a 4%-coupon 30-year bond for a price of par and posts the bond as collateral in a repo with zero haircut. The repo rate is 5%. Then, 183 days later, the...

Study smarter with the SolutionInn App