Suppose the price of a bond is dependent on the price of a commodity, denoted by Q

Question:

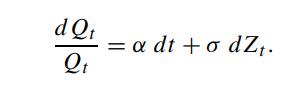

Suppose the price of a bond is dependent on the price of a commodity, denoted by Qt . Let the stochastic process followed by Qt be governed by

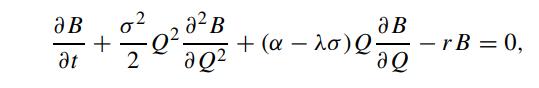

By hedging bonds of different maturities, show that the governing equation for the bond price B(Q,t) is given by [see (7.2.8)]

By hedging bonds of different maturities, show that the governing equation for the bond price B(Q,t) is given by [see (7.2.8)]

where λ is the market price of risk and r is the riskless interest rate. Since the commodity is a traded security (unlike the interest rate), the price of the commodity should also satisfy the same governing differential equation. Substituting Q for B into the differential equation, show that

![]()

Argue why the governing equation for the bond price now takes the same form as the Black–Scholes equation, which has no dependence on the risk preference.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: