Suppose we write the price function of the swaption as [see (8.4.9)], the resulting expression reveals a

Question:

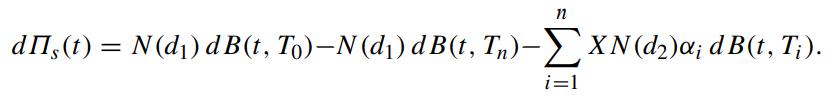

Suppose we write the price function of the swaption as

![n V(t; To, Tn, X) = N(d)[B(t, To) B(t, Tn)] - XN (d); B(t, T;), i=1](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/5/0/084655ddc64710841700650084942.jpg)

[see (8.4.9)], the resulting expression reveals a hedging strategy of the swaption using discount bonds with varying maturities. The replicating portfolio Πs(t) consists of a long position in N(d1) units of T0-maturity bond, a short position in N(d1) units of Tn-maturity bond and αiN(d2)X units of Ti-maturity bond, i = 1, 2, ··· ,n. Under the assumption of deterministic volatility function, show that the replicating portfolio Πs(t) is self-financing.

Check whether

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: