Suppose that the investor in Example 1 wishes to invest $10,000 in long- and short-term bonds, as

Question:

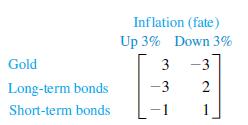

Suppose that the investor in Example 1 wishes to invest $10,000 in long- and short-term bonds, as well as in gold, and he is concerned about inflation. After some analysis, he estimates that the return (in thousands of dollars) at the end of a year will be as indicated in the following payoff matrix:

Again, assume that fate is a very good player that will attempt to reduce the investor’s return as much as possible. Find the optimal strategies for both the investor and for fate. What is the value of the game?

Data from Example 1

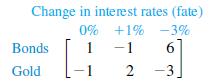

An investor wishes to invest $10,000 in bonds and gold. He knows that the return on the investments will be affected by changes in interest rates. After some analysis, he estimates that the return (in thousands of dollars) at the end of a year will be as indicated in the following payoff matrix:

We assume that fate is a very clever player and will play to reduce the investor’s return as much as possible. Find optimal strategies for both the investor and for “fate.” What is the value of the game?

Find the expected values of the game if the investor continues with his optimal strategy and fate “switches” to the following pure strategies:

(1) Play only 0% change;

(2) Play only +1% change;

(3) Play only -3% change.

Step by Step Answer:

Finite Mathematics For Business Economics Life Sciences And Social Sciences

ISBN: 9780134862620

14th Edition

Authors: Raymond Barnett, Michael Ziegler, Karl Byleen, Christopher Stocker