Suppose you finish college with $20,000 in student loans and start a job that pays a salary

Question:

Suppose you finish college with $20,000 in student loans and start a job that pays a salary of $40,000 in the first year. In 10 years, you must repay your college loans. Which would you prefer: stable prices, rising prices, or falling prices?

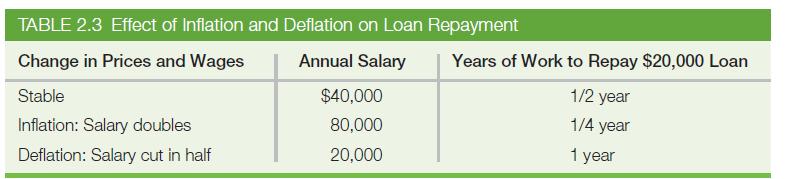

We can use the real-nominal principle to compute the real cost of repaying your loans. The first row of Table 2.3 shows the cost of the loan when all prices in the economy are stable—including the price of labor, your salary. In this case, your nominal salary in 10 years is $40,000, and the real cost of repaying your loan is the half year of work you must do to earn the $20,000 you owe. However, if all prices double over the 10-year period, your nominal salary will double to $80,000, and, as shown in the second row of Table 2.3, it will take you only a quarter of a year to earn $20,000 to repay the loan. In other words, a general increase in prices lowers the real cost of your loan. In contrast, if all prices decrease and your annual salary drops to $20,000, it will take you a full year to earn the money to repay the loan. In general, people who owe money prefer inflation (a general rise in prices) to deflation (a general drop in prices).

Question.

How does inflation affect lenders and borrowers?

Step by Step Answer:

Microeconomics Principles Applications And Tools

ISBN: 9780134078878

9th Edition

Authors: Arthur O'Sullivan, Steven Sheffrin, Stephen Perez