Agarwal, Bergeron, and Cishek have been in partnership for a number of years. The partners allocate all

Question:

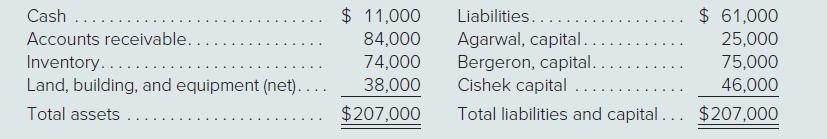

Agarwal, Bergeron, and Cishek have been in partnership for a number of years. The partners allocate all profits and losses on a 2:3:1 basis, respectively. Recently, each partner has become personally insolvent and, thus, the partners have decided to liquidate the business in hopes of remedying their personal financial problems. As of September 1, the partnership’s balance sheet is as follows:

Prepare journal entries for the following transactions:

a. Sold all inventory for $56,000 cash.

b. Paid $7,500 in liquidation expenses.

c. Paid $40,000 of the partnership’s liabilities.

d. Collected $45,000 of the accounts receivable.

e. Distributed safe payments of cash; the partners anticipate no further liquidation expenses.

f. Sold remaining accounts receivable for 30 percent of face value.

g. Sold land, building, and equipment for $17,000.

h. Paid all remaining liabilities of the partnership.

i. Distributed cash held by the business to the partners.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik