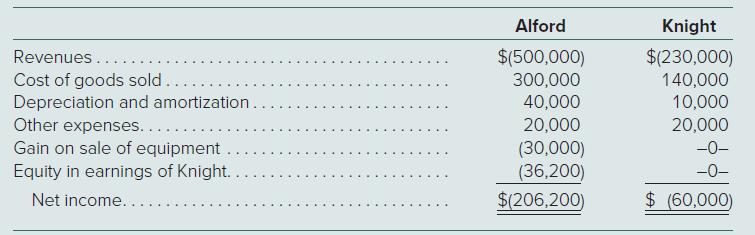

Alford Company and its 80 percentowned subsidiary, Knight, have the following income statements for 2024: Additional Information

Question:

Alford Company and its 80 percent–owned subsidiary, Knight, have the following income statements for 2024:

Additional Information for 2024

∙ Intra-entity inventory transfers during the year amounted to $90,000. All intra-entity transfers were downstream from Alford to Knight.

∙ Intra-entity gross profits in inventory at January 1 were $6,000, but at December 31 they are $9,000.

∙ Annual excess amortization expense resulting from the acquisition is $11,000.

∙ Knight paid dividends totaling $20,000.

∙ The noncontrolling interest’s share of the subsidiary’s income is $9,800.

∙ During the year, consolidated inventory rose by $11,000 while accounts receivable and accounts payable declined by $8,000 and $6,000, respectively.

Using either the direct or indirect method, compute net cash flows from operating activities during the period for the business combination.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik