Apollo Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its

Question:

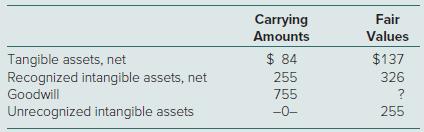

Apollo Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its qualitative assessment, one particular reporting unit, Stande, emerged as a candidate for possible goodwill impairment. Stande had recognized net assets with carrying amounts totaling $1,094, including goodwill of $755. Stande’s reporting unit fair value is assessed at $1,028 and includes two internally developed unrecognized intangible assets (a patent and a royalty agreement with fair values of $199 and $56, respectively). The following table summarizes current financial information for the Stande reporting unit:

a. Determine the amount of any goodwill impairment for Apollo’s Stande reporting unit.b. After recognition of any goodwill impairment loss, what are the reported carrying amounts for the following assets of Apollo’s reporting unit Stande?∙ Tangible assets, net∙ Goodwill∙ Patent∙ Royalty agreement

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik