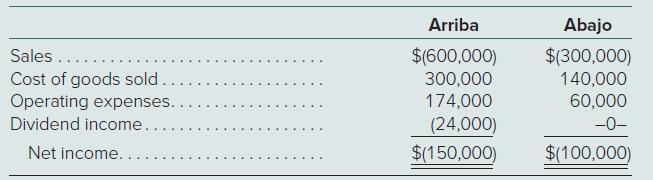

Arriba and its 80 percentowned subsidiary (Abajo) reported the following figures for the year ending December 31,

Question:

Arriba and its 80 percent–owned subsidiary (Abajo) reported the following figures for the year ending December 31, 2024 (credit balances indicated by parentheses). Abajo paid dividends of $30,000 during this period.

In 2023, intra-entity gross profits of $30,000 on upstream transfers of $90,000 were deferred into 2024. In 2024, intra-entity gross profits of $40,000 on upstream transfers of $110,000 were deferred into 2025.

a. What amounts appear for each line in a consolidated income statement? Explain your computations.

b. What income tax expense should appear on the consolidated income statement if each company files a separate return? Assume that the tax rate is 21 percent.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik