Bolero Company holds 80 percent of the common stock of Rivera, Inc., and 40 percent of this

Question:

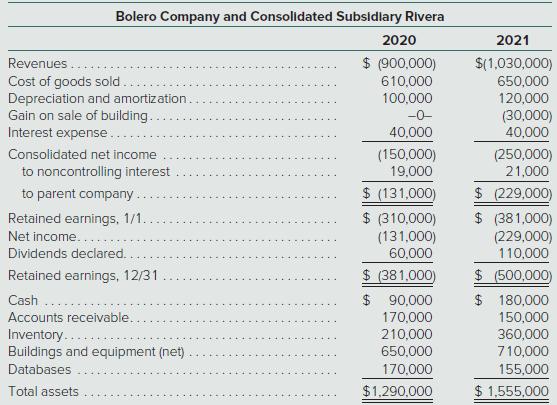

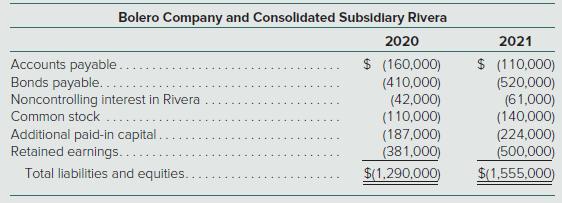

Bolero Company holds 80 percent of the common stock of Rivera, Inc., and 40 percent of this subsidiary’s convertible bonds. The following consolidated financial statements are for 2020 and 2021 (credit balances indicated by parentheses):

Additional Information for 2021

∙ The parent issued bonds during the year for cash.

∙ Amortization of databases amounts to $15,000 per year.

∙ The parent sold a building with a cost of $80,000 but a $40,000 book value for cash on May 11.

∙ The subsidiary purchased equipment on July 23 for $205,000 in cash.

∙ Late in November, the parent issued stock for cash.

∙ During the year, the subsidiary paid dividends of $10,000. Both parent and subsidiary pay dividends in the same year as declared.

Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2021. Use the indirect method to compute cash flow from operating activities.

Bolero Company and Consolidated Subsidlary Rivera 2020 2021 $ (900,000) $(1,030,000) 650,000 120,000 (30,000) 40,000 Revenues... Cost of goods sold. Depreciation and amortization. Gain on sale of building. Interest expense.. 610,000 100,000 -0- 40,000 Consolidated net income (150,000) 19,000 (250,000) 21,000 to noncontrolling interest $ (131,000) $ (310,000) (131,000) 60,000 $ (381,000) $ 90,000 $ 229,000) $ (381,000) (229,000) 110,000 to parent company.. Retained earnings, 1/1.. Net income... Dividends declared. $ 500,000) $ 180,000 Retained earnings, 12/31 Cash.... Accounts receivable. 170,000 150,000 Inventory.. Buildings and equipment (net) 210,000 360,000 710,000 155,000 650,000 Databases 170,000 Total assets $1,290,000 $ 1,555,000

Step by Step Answer:

BOLERO COMPANY AND CONSOLIDATED SUBSIDIARY RIVERA Consolidated Statement of Cash Flows Year Ending December 31 2021 CASH FROM OPERATING ACTIVTIES Cons...View the full answer

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Related Video

In order to determine the amount of cash created by operating operations, the indirect technique for preparing the statement of cash flows entails adjusting net income with changes in balance sheet.

Students also viewed these Business questions

-

Rodriguez Company holds 80 percent of the common stock of Molina, Inc., and 30 percent of this subsidiary's convertible bonds. The following consolidated financial statements are for 2012 and 2013:...

-

Rodriguez Company holds 80 percent of the common stock of Molina, Inc., and 30 percent of this subsidiarys convertible bonds. The following consolidated financial statements are for 2010 and 2011:...

-

Compute net cash flow from operating activities for Tulsa Corporation under the indirect reporting format. Tulsa Corporation provided you with the following information for the current year. Compute...

-

(1.0.5) (2, 2) (1,0) lim f(x) #-1+ For this part, no explanation is needed. Use the graph to calculate the limits: (2,1) lim f(x) 2-2+ lim f(x) 2-1 For this part, no explanation is needed. Use the...

-

The orbital diagram that follows shows the valence electrons for a 2+ ion of an element. (a) What is the element? (b) What is the electron configuration of an atom of this element? 4d

-

Under what circumstances would a static budget be appropriate? AppendixLO1

-

Two-tailed test, n = 14, a = 0.01

-

To more efficiently manage its inventory, Treynor Corporation maintains its internal inventory records using first-in, first-out (FIFO) under a perpetual inventory system. The following information...

-

The typical classification of the account in the balance sheet: Current asset CA Investments and funds INV Property, plant & equipment PPE Intangible assets INT Other assets OA Current liabilities CL...

-

1. Quantity of readimix required for the footing (cy) 2. Quantity of rebar in the footing (# dowels and If of #5) 3. Quantity of wall-form required for the concrete wall (sf) 4.Quantity of readimix...

-

On January 1, 2020, Mona, Inc., acquired 80 percent of Lisa Companys common stock as well as 60 percent of its preferred shares. Mona paid $65,000 in cash for the preferred stock, with a call value...

-

On June 30, 2021, Plaster, Inc., paid $916,000 for 80 percent of Stucco Companys outstanding stock. Plaster assessed the acquisition-date fair value of the 20 percent noncontrolling interest at...

-

A long power transmission cable is buried at a depth (ground-to-cable-centerline distance) of \(1 \mathrm{~m}\). The cable is encased in a thin-walled pipe of \(0.05-\mathrm{m}\) diameter, and, to...

-

From your reading this unit on motivation and change from the TIP series, what is the connection and interplay between these concepts/statements below in your opinion in working with clients facing...

-

Please help with the following The partnership of Bauer, Ohtani, and Souza has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the...

-

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,200 cases of Oktoberfest-style beer from a German supplier for 276,000 euros. Relevant U.S. dollar exchange rates for the euro...

-

Define meaning of partnership deed.

-

List down the information contains in the partnership deed.

-

The following table shows the consumer price index (CPI) for the years 20132018. a) Determine the linear correlation coefficient, r, between the year and the CPI. b) If 2013 is subtracted from each...

-

Evaluate the function at the given value(s) of the independent variable. Simplify the results. (x) = cos 2x (a) (0) (b) (- /4) (c) (/3) (d) ()

-

Many companies make annual reports available on their corporate Internet home page. Annual reports also can be accessed through the SEC's EDGAR system at www.sec.gov (under Filing Type, search for...

-

Many companies make annual reports available on their corporate Internet home page. Annual reports also can be accessed through the SEC's EDGAR system at www.sec.gov (under Filing Type, search for...

-

Moxie Corporation incurs research and development costs of $500,000 in 2013, 30 percent of which relates to development activities subsequent to certain criteria having been met that suggest that an...

-

Problem 12.6A (Algo) Liquidation of a partnership LO P5 Kendra, Cogley, and Mel share income and loss in a 3.21 ratio (in ratio form: Kendra, 3/6: Cogley, 2/6; and Mel, 1/6), The partners have...

-

Melody Property Limited owns a right to use land together with a building from 2000 to 2046, and the carrying amount of the property was $5 million with a revaluation surplus of $2 million at the end...

-

Famas Llamas has a weighted average cost of capital of 9.1 percent. The companys cost of equity is 12.6 percent, and its cost of debt is 7.2 percent. The tax rate is 25 percent. What is the companys...

Study smarter with the SolutionInn App