BT Group ple is a global British telecommunications services company headquartered in London. Its financial statements are

Question:

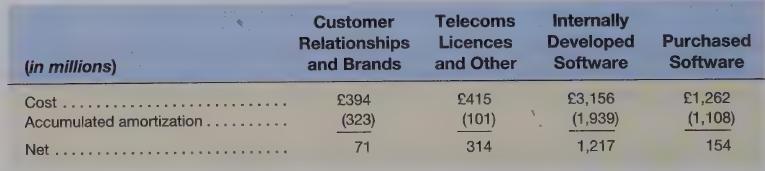

BT Group ple is a global British telecommunications services company headquartered in London. Its financial statements are prepared using IFRS. For the year ended 31 March 2014, BT Group reports the following identifiable intangible assets:

Required

a. Of the four types of identifiable intangibles reported, which are most likely to have been acquired in business combinations?

b. Would U.S. GAAP report the same balances as above for identifiable intangibles as IFRS? Explain.

c. Below are some assumed situations for BT Group’s identifiable intangibles.

(1) Assume that intangibles costing £40 million (10-year life), acquired 1 April 2015, are traded in an active market. BT Group amortizes them on a straight-line basis. On 31 March 2016, the market value of these items is £45 million. One year later, new developments reduce the market value to £30 million. Prepare all journal entries related to these intangibles, per IFRS, on 31 March 2016 and 2017. BT Group uses the revaluation approach for qualifying intangibles.

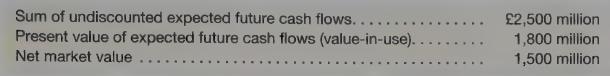

(2) Assume BT Group recognizes customer relationships valued at £2,500 million in a 1 April 2016 acquisition. These intangibles are straight-line amortized over 5 years, using the cost model. On 31 March 2017, the following information is gathered concerning these intangibles:

Calculate the impairment loss recognized under IFRS and U.S. GAAP, assuming BT Group bypasses the qualitative assessment allowed under U.S. GAAP. What do you conclude about the relative impairment losses recognized under IFRS and U.S. GAAP?

Step by Step Answer: