Caterpillar uses U.S. GAAP when preparing its consolidated financial statements. Information concerning inventories from their 2017 annual

Question:

Caterpillar uses U.S. GAAP when preparing its consolidated financial statements. Information concerning inventories from their 2017 annual report is as follows: Inventories are stated at the lower of cost or net realizable value. Cost is principally determined using the last-in, first-out (LIFO) method. The value of inventories on the LIFO basis represented about 65 percent and 60 percent of total inventories at December 31, 2017, and 2016. If the FIFO (first-in, first-out) method had been in use, inventories would have been $1,934 million, $2,139 million, and $2,498 million higher than reported at December 31, 2017, 2016 and 2015, respectively. During 2017, inventory quantities were reduced. This reduction resulted in a liquidation of LIFO inventory resulting mostly from closure of our facility in Gosselies, Belgium. The liquidated inventory was carried at lower costs prevailing in prior years as compared with current costs. In 2017, the effect of this reduction in inventory decreased cost of goods sold by approximately $66 million and increased profit by approximately $49 million or $.08 per share.

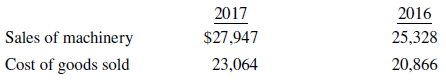

In July 2015, the FASB issued accounting guidance which requires that inventory be measured at the lower of cost or net realizable value. Prior to the issuance of the new guidance, inventory was measured at the lower of cost or market. Replacing the concept of market with the single measurement of net realizable value is intended to create efficiencies for preparers. Inventory measured using the last-in, first-out (LIFO) method and the retail inventory method are not impacted by the new guidance. The guidance was effective January 1, 2017, and was applied prospectively. The adoption did not have a material impact on our financial statements. In addition, Caterpillar reported sales of machinery and cost of goods sold for 2017 and 2016 as follows (in thousands):

CNH Industrial uses IFRS when preparing its consolidated financial statements. Information concerning inventories from their 2017 annual report is as follows: Caterpillar lists CNH as a global competitor in its annual report. CNH reports inventory as follows:

Inventories

Inventories of raw materials, semi-finished products, and finished goods (including assets leased out under operating lease) are stated at the lower of cost or market. Cost is determined by the first-in-first-out (FIFO) method. Cost includes the direct costs of materials, labor, and indirect costs (variable and fixed). Provision is made for obsolete and slow-moving raw materials, finished goods, spare parts, and other supplies based on their expected future use and realizable value. Net realizable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs for sale and distribution. CNG reported sales of machinery and cost of goods sold for 2017 and 2016 as follows (in thousands):

Required:

A. What difficulties exist when comparing companies when they use different accounting standards? In this example, what are the accounting differences related to inventory?

B. Compute the gross margin percentage for each company for 2017 and 2016. Discuss the results.

C. Redo the gross margin percentage for Caterpillar assuming that they used FIFO in place of LIFO. Does this change your comparison? Regardless of your answer, which approach is better (adjusting LIFO to FIFO or ?as reported?)?

D. Caterpillar?s current ratio for 2017 was 1.345, and CNH?s current ratio was 2.52. Does the choice of inventory method affect these computations? Consider Caterpillar?s current ratio. Is it likely to be higher or lower than 1.345 if FIFO were used? How much would it change if FIFO were used (ignore taxes).

GAAPGenerally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer: